Nvidia Corporation (NASDAQ:NVDA) is a semiconductor company that has gained a reputation as a leader in the graphics processing unit (GPU) market. The company’s stock has been on a steady rise, with the price on a rampage in March 2023 on the back of all the AI euphoria. However, despite the upward trend, there are indications that NVDA is overbought and could experience a price correction in the near future. This article will explain why NVDA’s stock is overbought and why it is likely to fall in price.

Overbought Conditions

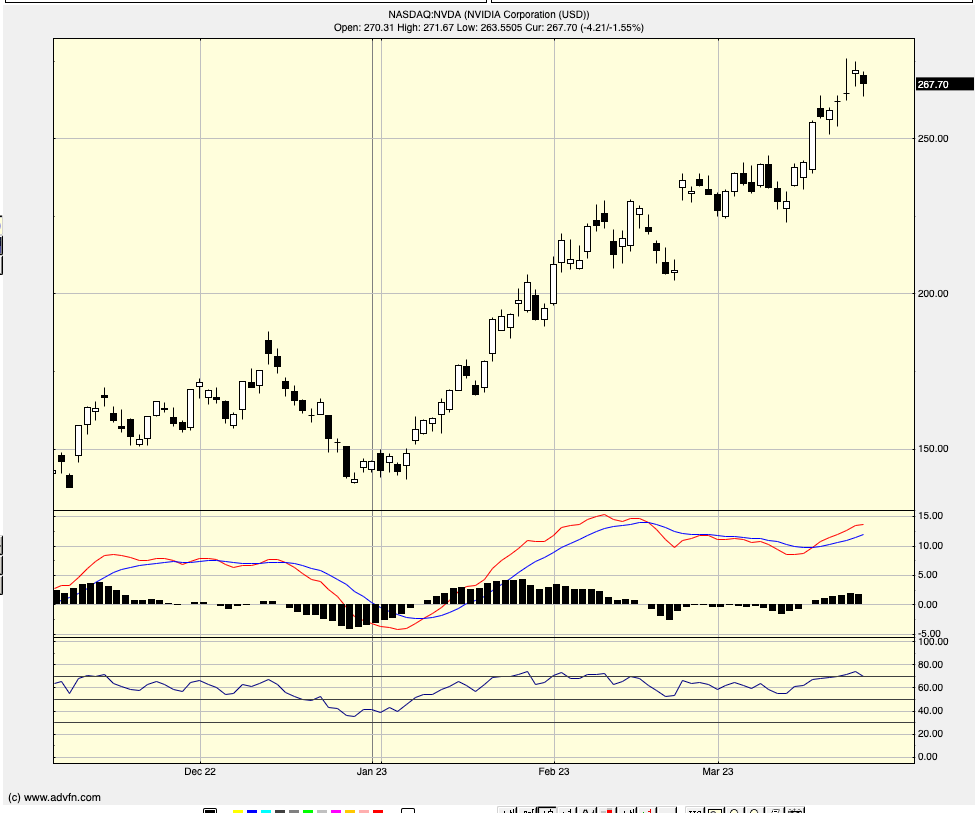

One way to measure whether a stock is overbought is by using technical indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD). The RSI measures the magnitude of a stock’s recent gains relative to its recent losses and ranges from 0 to 100. When the RSI is above 70, it indicates that the stock is overbought and could be due for a price correction. As of March 2023, NVDA’s RSI is above 90, indicating that it is significantly overbought.

The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a stock’s price. When the MACD crosses above its signal line, it indicates a bullish signal, while a crossover below the signal line is a bearish signal. As of March 2023, NVDA’s MACD is significantly above its signal line, indicating that it is overbought and due for a price correction.

Reasons for a Potential Price Correction

There are several reasons why NVDA’s stock could experience a price correction. First, the semiconductor industry is cyclical, and periods of strong demand are often followed by periods of weaker demand. The strong demand for GPUs, which has driven NVDA’s growth, could slow down as the market becomes saturated, leading to a decline in sales and revenue.

Second, NVDA’s valuation is high, with a forward price-to-earnings (P/E) ratio of over 60 as of March 2023. This high valuation implies that the stock is priced for significant growth, and any signs of slowing growth could lead to a price correction.

Finally, there is always the risk of unexpected events that could negatively impact the stock price. For example, a global economic slowdown, political instability, or a decline in consumer demand for GPUs could all lead to a price correction.

Conclusion

In conclusion, NVDA’s stock is currently overbought based on technical indicators such as the RSI and MACD. While the company has a strong reputation and has experienced significant growth in recent years, there are several factors that could lead to a price correction. The cyclical nature of the semiconductor industry, high valuation, and unexpected events all pose a risk to NVDA’s stock price. Investors should be aware of these risks and consider them when making investment decisions.