Rates Pressure Stocks

The tech-heavy Nasdaq Composite fell on Tuesday due to the rising bond yields and concerns over further interest rate increases by the Federal Reserve. With easing anxiety about global banks, investors are now renewing their bets that interest rates may rise further and remain elevated. The broad S&P 500 index also declined, while the Dow Jones Industrial Average slipped slightly.

Europe, Asia Shares Rise

European stocks and Asian shares rose, with the Hong Kong market rallying on a planned revamp of Alibaba Group Holdings Ltd., which is seen as a positive development for Chinese technology companies. The Stoxx Europe 600 Index climbed, with tech and consumer shares gaining the most. A gauge of Asian stocks rose for a second day as benchmarks in Japan and Australia also increased.

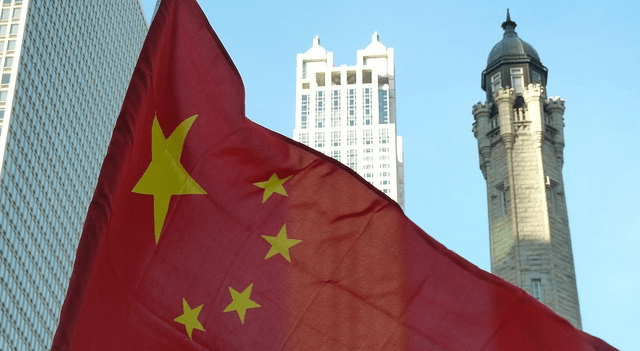

China Threatens Taiwan Meeting

China has threatened to retaliate if Taiwan’s president, Tsai Ing-wen, meets with the House Speaker, Kevin McCarthy, in America. China considers Taiwan its own territory, and a meeting between Tsai and McCarthy “would harm [its] sovereignty.” Tsai is currently traveling to Belize and Guatemala, two of the few remaining countries that maintain diplomatic relations with Taiwan. She may meet McCarthy on her way back.

US Housing Slump Continues

The US housing slump continued in January, with home prices falling 0.2% from December, according to seasonally adjusted data from S&P CoreLogic Case-Shiller. The index is down 3% from its record high reached in June. As buyer demand has been weak for months, sellers have become more willing to offer discounts, and mortgage rates eased slightly from the peak in November, giving some house hunters the incentive to negotiate a deal.

Banga Nominated World Bank

The nomination period for the next president of the World Bank ends on Wednesday, and there is only one candidate, Ajay Banga, the former CEO of Mastercard, who is expected to start in June. Despite his lack of government experience, he could be a decent fit for the bank’s biggest challenge of helping poor countries tackle climate change, as he has been involved in several climate initiatives at Mastercard.

Ukraine’s Grain Glut Damage

Ukraine’s tariff-free access to the EU has resulted in a grain glut in neighboring countries, which has damaged the regional agricultural sector and led to complaints that Brussels is paying farmers too little compensation. After Russia invaded Ukraine last year, the EU scrapped customs duties and quotas on Ukrainian grain imports and rerouted some shipments that Russia was blocking in Black Sea ports through Polish and Romanian roads and railway networks, undercutting local producers.

Spain Requires Pension Reforms

Spain is moving forward with pension reforms that will require younger people to pay more to help fix years of expensive promises to retirees. While France is in revolt over plans to raise the minimum retirement age, Spain’s threshold has been 65 for decades, leaving the country to search for alternative ways to support its pension system while being fair to both young and old. The government will ask lawmakers to approve the new measures on Thursday.

UK NHS Satisfaction at Low

Public satisfaction with the NHS in England, Scotland, and Wales has fallen to its lowest level in 40 years, according to the British Social Attitudes Survey. The latest results, referring to 2022, reflect the NHS’s poor performance, with more than 7 million people waiting for hospital treatment and the worst A&E waits and ambulance response times on record. Growing demand and staff vacancies have compounded the pressures on the health service in the wake of the coronavirus pandemic.

Advertising Continues Growing in 2023

Despite mixed economic signals, advertising is expected to continue growing in 2023, according to a quarterly forecast by Magna, a media intelligence and investment firm. The firm predicts that media owners’ U.S. ad revenues will grow 3.4% to $326 billion, slightly lower than its earlier estimate of 3.7%. The forecast anticipates little or no growth in the first half of the year, followed by recovery as the economy stabilizes. Although the economy showed early signs of improvement in January and February, recent financial turbulence has caused concern for consumers and businesses.

Sweden’s Wind Power Success

Sweden’s focus on renewables appears to be paying off as wind turbines generated more than a quarter of the country’s power for two consecutive months. In February, wind power accounted for a record 27% of total generation, up from 26% in January, according to energy think-tank Ember. Last year, as the energy crisis hit Europe, Sweden installed 2.4 GW of new wind capacity, with only Germany installing more. Increased wind generation was able to compensate for a 6% decrease in Sweden’s hydropower output as droughts swept the continent.