Netflix’s Mixed Revenue Results

Netflix (NASAQ:NFLX) reported Q1 2023 revenues of $8.16bn, a 4% YoY rise, beating analysts’ estimates, but its Q2 estimate of $8.24bn was less than the $8.47bn expected by Wall Street analysts. The news initially caused a 10% drop in Netflix shares during after-hours trading, but they later recovered. The company also announced it would delay the rollout of a scheme to make users pay to share passwords, which had already resulted in annoyed subscribers cancelling plans in markets where it was introduced.

Goldman’s Profit Fall

Goldman Sachs (NYSE:GS) reported a YoY profit fall of 18%, with Q1 2023 profits at $3.2bn, due to a failed attempt to build a large consumer bank, a slowdown in dealmaking last year, and a loss of approximately $200m during the market turmoil following the collapse of Silicon Valley Bank. In January, Goldman announced that it would fire 3,000 employees.

Bank of America Cuts Jobs

Bank of America (NYSE:BAC) announced that it plans to cut up to 4,000 positions before the end of June, representing 2% of its overall workforce, even though it beat first-quarter profit expectations. Bank of America’s headcount had grown by 4% by the end of March, topping 217,000 as the job market heated up during the pandemic era.

J&J Talcum Powder Loss

Johnson & Johnson (NYSE:JNJ) reported a Q1 loss after booking a $6.9bn charge linked to its proposal to settle tens of thousands of legal claims alleging that its talcum powder caused cancer. Although the company said it was unfortunate to pay claimants for what it described as “baseless scientific claims,” it noted that protracted litigation was costly and “inherently uncertain.” J&J said that 60,000-70,000 talc claimants supported its proposal, despite a push by a small group of plaintiffs’ lawyers to restrict their clients from voting on a settlement proposed in a bankruptcy scheme.

United Airlines Losses Reported

United Airlines Holdings (NASDAQ:UAL) reported a Q1 net loss of $194m, but United CEO Scott Kirby said demand for travel remains strong, particularly internationally, where growth was twice that of the domestic rate. The airline expects earnings of $3.50 to $4 a share in Q2, which is typically a time when travel demand accelerates due to vacations.

Southwest Flights Delayed

Southwest Airlines (NYSE:LUV) flights faced delays, affecting over half of the airline’s flights, due to fallout from a technology problem that briefly halted its operation earlier in the day. Southwest temporarily halted flights to work through data-connection issues after an internal technical problem. The FAA cancelled Southwest’s pause in departures, which the airline had requested. The carrier said a firewall supplied by a vendor went down, and the connection to some operational data was unexpectedly lost.

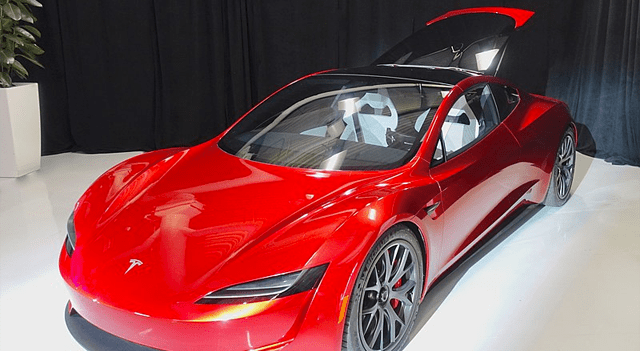

Tesla Cuts Model Prices Again

Tesla (NASDAQ:TSLA) has reduced the prices of its popular models, the Model Y and Model 3, for the second time in the US this month. The long-range Model Y’s price dropped 5.6% to $49,990, while the performance version decreased by 5.2% to $53,990. Additionally, the base Model 3 is now priced at $39,990, a 4.7% reduction. This move suggests that CEO Elon Musk is prioritizing stoking demand over Tesla’s profitability. In contrast, other EV makers, including Ford, Rivian, and Lucid Group, are struggling to make profits with lower volumes.

Law Enforcement Criticizes Meta

The FBI, Interpol, and the UK’s National Crime Agency have criticized Meta’s (NASDAQ:META) decision to increase end-to-end encryption, which they claim “blindfolds” them to child sex abuse. The Virtual Global Taskforce, consisting of 15 law enforcement agencies, issued a joint statement, stating that Facebook and Instagram’s parent company, Meta, purposely designed the encryption to degrade safety systems, particularly in protecting children. The law enforcement agencies emphasized the need for technology companies to balance safeguarding children online with protecting users’ privacy.

Asian Fund Managers Lag in ESG

According to the World Wide Fund for Nature Singapore’s 2022 Respond assessment report, Asian fund managers are significantly behind their European counterparts in addressing environmental, social, and governance risks, particularly nature-based risks, responsible investing disclosure, and governance. Chinese asset managers’ ESG efforts were especially lacking, with their average assessment score decreasing from last year. The report calls for improvements to develop resilient and sustainable portfolios that protect nature and support decarbonization.

Allianz X Sells N26 Stake

Allianz X (ETR:ALV), the venture capital arm of the Munich insurance group, is selling its stake of approximately 5% in fintech N26 at a discount of 68%, valuing the company at $3bn. This steep discount highlights how high-growth start-ups have fallen out of favor with investors. This comes after investors valued N26 at $9bn during its last funding round in October 2021.

Just Eat Takeaway Buyback

Just Eat Takeaway (AMS:TKWY) will buy back up to €150mn worth of shares following a 14% decrease in the number of orders placed globally in the first quarter to 227.8mn. The decline in orders, due to rising food prices and cost-of-living pressures, has led Just Eat to raise prices and delivery fees, as well as cut costs. The company projects adjusted earnings to grow from €19mn in 2022 to €275mn this year, even though it continues to recover from last year’s deceleration.

CMA CGM’s Bolloré Offer

CMA CGM, the French shipping company, has offered to buy billionaire Vincent Bolloré’s logistics business for €5bn. The two groups are currently in exclusive negotiations, and Bolloré Group (EPA:BOL) has set a deadline of May 8 to finalize its offer. CMA CGM has continued its acquisition spree after making significant profits during the pandemic.