Mixed Earnings Affect Stocks

European stocks showed a slight decrease while US equity futures declined as investors analyzed mixed corporate earnings and reviewed the most recent assessment of the US economy for hints about the path for interest rates. The Stoxx Europe 600 (STOXX:SSXP) saw a boost in banking stocks, but autos experienced a decline, specifically Renault SA (EPA:RNO) following its first-quarter sales update. Meanwhile, L’Oreal SA (EPA:OR) reported robust demand and gained as a result. However, contracts for the Nasdaq 100 (NASDAQI:NDX) and S&P 500 (SPI:SP500) went down more than 0.4%.

Oil Prices Fall on US Slowdown

Despite a significant draw in crude stockpiles, oil prices fell for the third time in four days due to further indications of a US slowdown. The global benchmark Brent dropped below $83 a barrel after a 2% dip on Wednesday. According to the Federal Reserve’s Beige Book survey, the US economy has stalled in recent weeks, casting a shadow over energy demand. Another factor contributing to this downturn was the rise in the dollar, which created another obstacle for commodities.

IBM Meets Annual Revenue Forecast

International Business Machines Corp. (NYSE:IBM) announced a forecast for annual revenue, which met analysts’ estimates, indicating technology spending in an uncertain economy. In a statement released on Wednesday, the company stated that sales would rise from 3% to 5% in 2023. IBM affirmed a previous free cash flow projection of $10.5 billion for the year. Although IBM’s first-quarter revenue was $14.3 billion, which was slightly below analysts’ average estimate, profit, excluding some items, was $1.36 a share in the quarter ended March 31. Analysts anticipated $1.25 a share, according to Bloomberg data.

Deliveroo Reports 9% Drop in Orders

Deliveroo Plc (LSE:ROO) reported that orders fell 9% in the first quarter as customers reduced their meal delivery spending. In a statement released on Thursday, the company stated that users placed 72.1 million orders in the first quarter, down from 78.8 million a year ago. Gross transaction value decreased by 1% to £1.75 billion ($2.2 billion) on a constant currency basis.

UK Money Market Funds Inflows Rise

Prior to the tax year end on April 5, UK-based money market funds experienced an increase in inflows as rising rates made them more appealing to retail investors. Market leaders Hargreaves Lansdown and Interactive Investor reported that customers turned to money market funds in the first quarter of the year as yields increased. Hargreaves experienced a “huge increase” in net flows into money market funds, while Interactive Investor saw a 300% increase in the same period.

Nestle Shareholders Pressure for Healthier Products

A group of institutional investors in Nestlé (SWX:NESN) has increased pressure on the world’s largest food company to reduce its dependence on unhealthy products, warning that excessive consumption of packaged goods with limited nutritional value poses “systemic risks” to financial returns. Shareholders with more than $3tn in combined assets under management are asking the Switzerland-based company to set a target to increase its revenue from healthier foods and drinks. They stated that they are prepared to “escalate” the matter unless the directors address their concerns.

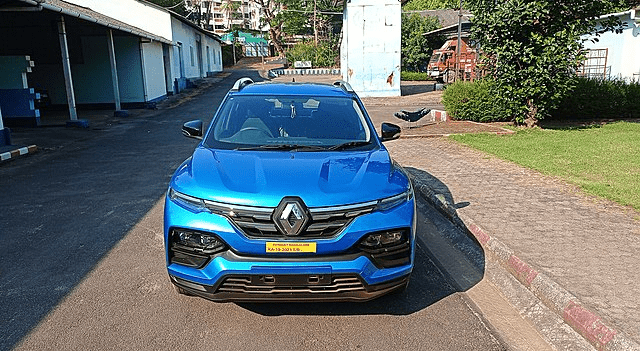

Renault Warns Against Reducing EV Prices

French carmaker Renault (EPA:RNO) has cautioned that reducing electric vehicle prices will negatively impact the residual value of the cars. Renault’s main objective is to keep monthly lease payments low, which necessitates protecting a car’s residual value. Renault’s finance chief, Thierry Piéton, stated that reducing prices would lead to a decline in residual value, and Renault is not interested in cutting prices significantly, which would harm the residual value of cars and lead to a competition-like spiral. Renault will accept lower sales volumes in the short term if it protects the value of its cars.

Credit Suisse Investors Consider Legal Action

80 Credit Suisse (NYSE:CS) investors in Singapore are negotiating a lawsuit against the Swiss government over its decision to write down $17 billion of Credit Suisse bonds, alleging that it breaches a free trade agreement. Law firm Wilmer Hale is in talks with bondholders, who argue that the move violated protections against unfair state actions in the Singapore-European Free Trade Association signed with Switzerland in 2003. The lawsuit in Singapore will introduce a new legal battle against Switzerland for wiping out the bonds as part of the bank’s state-sponsored takeover by UBS (NYSE:UBS).

UBS Records Largest ETF Outflows in Europe

UBS (NYSE:UBS) had the largest net outflows for exchange-traded funds (ETFs) in Europe last month, with investors concerned about its takeover of Credit Suisse (NYSE:CS). According to Morningstar data, Europe’s ETF industry received inflows of €13.1 billion in March, with iShares receiving the most at €7.7 billion. UBS ETFs saw €2 billion in net outflows, while Credit Suisse had the second-largest outflows in Europe at €179 million. UBS’s MSCI ACWI Socially Responsible ETF was the hardest hit, with €1 billion in outflows, while its MSCI Canada and MSCI Australia ETFs had the third and eighth-largest outflows, respectively, at €517 million and €347 million.

Google Plans to Use Generative AI in Advertising

Google (NASDAQ:GOOG) is planning to use generative artificial intelligence in its advertising business in the next few months, as tech firms race to incorporate cutting-edge technology into their products. According to an internal presentation to advertisers, Google intends to use AI to produce innovative advertisements based on materials created by human marketers. The company stated that “generative AI is unlocking a world of creativity” in the presentation titled “AI-powered ads 2023.”

Western Alliance Bancorp’s Rebound in Deposits

Western Alliance Bancorp’s (NYSE:WAL) rebound in deposits buoyed US regional bank stocks on Wednesday. Western Alliance reported that it regained almost $3 billion in deposits in the past few weeks, or more than 40% of the amount that had hit the Phoenix-based bank since January 1, as it revealed first-quarter earnings. As one of the first regional banks to report results after the collapse of SVB and Signature Bank (OTC:CBNY), Western Alliance was viewed by investors as a potentially favorable bellwether for the rest of the sector, which led to an uptick in regional bank stocks.

Instagram Relocates Head and Staff

Instagram is relocating its head, Adam Mosseri, and most of its staff from London as its parent company Meta (NASDAQ:META) undertakes a restructuring of tens of thousands of employees. Although its engineering and product teams worked in the UK, Facebook and WhatsApp-owner was building an Instagram hub there. According to three sources familiar with the plans, the social media company is now requesting staff to move to the United States. Mosseri relocated to London less than eight months ago. Instagram will primarily be located in New York, where it already has extensive staff teams.

Virgin Media O2 Considers Sale of Tower Network

Virgin Media O2 has started the sale of part or all of its share in the largest mobile tower network in the UK. The proceeds from this sale could be used to expand its mobile operations and fibre broadband. The company owns half of Cornerstone, which manages its mobile infrastructure in the UK, with the other half belonging to Vantage Towers, backed by Vodafone. Virgin Media O2 has begun the process to sell at least 25% of its stake in the business, and is open to selling the entire stake depending on offers.

Bed Bath & Beyond Prepares for Bankruptcy

Struggling retailer, Bed Bath & Beyond Inc. (NASDAQ:BBBY), is reportedly preparing to file for bankruptcy this weekend. With its stock price plummeting, the company is finding it increasingly difficult to raise enough capital to avoid default. Bed Bath & Beyond recently announced that it needed to raise $300 million from share sales by April 26 to avoid chapter 11 bankruptcy. However, given the stock’s closing price of 46 cents on Wednesday, the company faces an uphill battle to raise that amount of money within that time.

Chinese Chipmaker Plans $14.5bn IPO

Changxin Memory Technologies Inc., a Chinese chipmaker, plans to file for a domestic IPO this year. The company aims to debut on Shanghai’s Nasdaq-style STAR board, with a valuation of no less than $14.5 billion, which could help bolster China’s technology aspirations. Known as CXMT, the memory chip maker is in the process of selecting underwriters, and the IPO’s size has not been finalized yet. According to insiders, the IPO could value the company north of $14.5 billion.