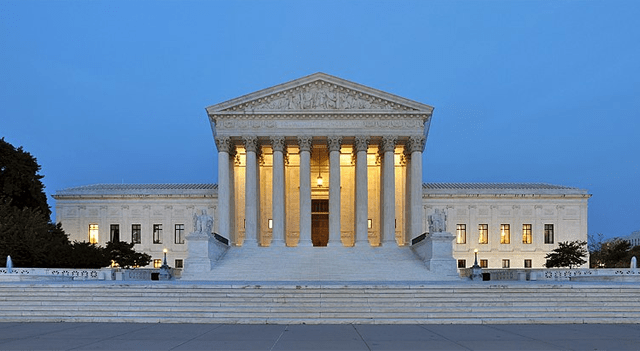

US Supreme Court Extends Abortion Pill Freeze

The US Supreme Court has extended its freeze on a lower court ruling that would have restricted access to the abortion pill, mifepristone, until Friday. This will keep the drug available while the justices consider whether to keep it on the market. A federal judge in Texas had previously suspended approval of the drug, prompting a series of appeals.

India’s Opposition Leader’s Plea Rejected

The opposition leader of India, Rahul Gandhi, has had his plea to stay his conviction for defamation rejected by a local court. Gandhi’s party, Congress, has vowed to appeal the decision at a higher court. Gandhi was convicted last month and subsequently disqualified from office due to comments he made that were deemed insulting to the Prime Minister, Narendra Modi, and those with the same surname.

Ukraine Receives Advanced Patriots System

Ukraine has announced that it has received its first Patriots, which are the most advanced missile- and air-defence system in the West, from America, Germany, and the Netherlands. On Wednesday, Ukraine reported that Russia had launched 60 air strikes in the previous 24 hours, mainly focused on the town of Bakhmut. Ukraine is expected to request more air-defence weapons in a meeting with allies this week, according to the Financial Times.

Fighting Continues in Sudan’s Capital

Fighting has continued for a fifth day between Sudan’s ruling military junta and the Rapid Support Forces militia, causing thousands of civilians to flee Khartoum, the capital of Sudan. A 24-hour “ceasefire” on Tuesday was broken, with both sides blaming each other. The fighting has resulted in at least 270 civilian deaths and over 2,600 injuries, with the UN’s secretary-general, António Guterres, warning that the humanitarian situation has become “catastrophic.”

FDIC Sells Bonds to Recoup Cost

The Federal Deposit Insurance Corp. (FDIC) has begun selling high-quality mortgage-backed bonds to recoup the cost of rescuing depositors from failed banks Silicon Valley Bank and Signature Bank. The FDIC put up for auction approximately $700 million worth of bonds on Tuesday, which could prove to be a test of how much the US government can recover on the $114 billion face value of the bonds it assumed. The FDIC estimates a $3.3 billion net loss from depositor payouts, which will be reimbursed through an assessment on other banks.

Republican Speaker Outlines Debt Ceiling Plans

The Republican speaker of the House, Kevin McCarthy, has outlined his plans for averting a US debt ceiling crisis with a bill that would push the risk of default into next year, but requires the rolling back of several White House policies. McCarthy and House Republicans have attempted to link raising the debt ceiling to steep budget cuts, while President Joe Biden and congressional Democrats have urged Republicans to agree to a higher federal borrowing limit without conditions. Some estimates warn that a failure to raise the debt ceiling could plunge the US government into default as soon as June.

Brussels Prepares Emergency Curbs on Grain Imports

Brussels is preparing emergency curbs on Ukrainian grain imports to five member states near the war-torn country, bowing to pressure from Poland and Hungary after they took unilateral action to pacify local farmers. European Commission President Ursula von der Leyen said the bloc would take “preventive measures” as EU officials attempted to respond to several countries, including some of Kyiv’s staunchest allies, breaking ranks to defend their farmers from an influx of cheap grain. The steps under discussion would bar imports of those products until June into the four member states bordering Ukraine plus Bulgaria, except for re-export to other EU member states or parts of the world.

Australia’s Central Bank to Undergo Major Reforms

Australia’s central bank, the Reserve Bank of Australia (RBA), is set to undergo major reforms after its first review in four decades. The country’s treasurer has proposed the creation of a new interest rate-setting board and an overhaul of the bank’s culture. The decision comes after the RBA received criticism for its handling of interest rate guidance and slow response to rising inflation. Despite the governor’s indication that rates would not be raised until 2024, the bank has raised rates for 10 consecutive months starting in May, only pausing in the previous month.

Foreign Companies Face New Tax in Russia

As foreign companies prepare to leave Russia, they face a new challenge with the introduction of a windfall tax on top of the already required 50% discount and government permission to exit. According to anonymous sources, the new tax will also apply to those negotiating exit deals, possibly affecting the negotiated price of divestment. The Russian Finance Ministry has not yet commented on the matter. The tax will not offer exemptions, as the country’s budget requires the additional funds. This new tax is just one of the many surprises for foreign companies exiting the country.