Main subjects of the day

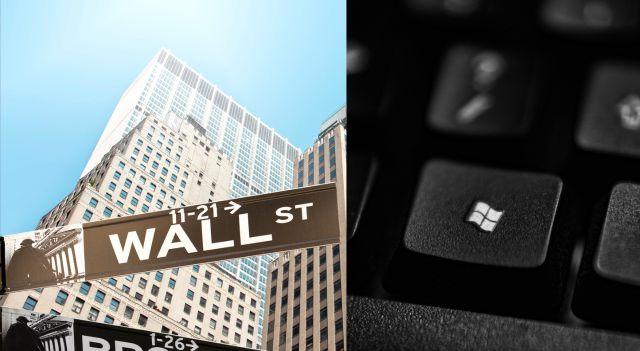

US stock futures rose on Wednesday morning as Big Tech earnings began to roll in, starting with earnings from Alphabet and Microsoft.

By 8:09 AM, Dow Jones futures were up 0.10%, while S&P 500 futures were up 0.09% and Nasdaq 100 futures gained 0.76%.

In regular Tuesday trading, major indexes tumbled as First Republic Bank’s earnings report reignited concerns about the broader sector. The Dow fell 344.57 points, or 1.02%, to close at 33,530.83 points. The S&P 500 fell 1.58%, or 65.41 points, to 4,071.63 points. The Nasdaq Composite fell 1.98%, or 238.05 points, to close at 11,799.16 points.

US Treasury yields rise on Wednesday. By 8:20 AM, the 10-year Treasury yield was up 0.015 points to 3.413% and the 2-year Treasury note yield was up +0.022 to 3.918%, after falling around 20 basis points on the Tuesday. Yields and prices move in opposite directions.

Investors weigh the outlook for Federal Reserve interest rate policy as they analyze this week’s key economic data. This Wednesday, traders will be monitoring Durable Goods and Mortgage Purchases at 8:30 AM. At the same time, the goods trade balance and preliminary wholesale inventories will be released. At 10h30 AM, US Crude Oil Inventories will be released. At 13:00, the Auction of 5 Year Notes will be launched. On Thursday, the latest GDP update is expected. The Personal Consumption Expenditure Price Index, the Fed’s preferred inflation gauge, will be out on Friday.

Microsoft has beaten Wall Street’s expectations, and revenue in its smart cloud business segment has seen a huge jump. Shares were up nearly 8% in premarket trading. Elsewhere, Britain’s top competition regulator moved on Wednesday to block Microsoft’s takeover of video game publisher Activision Blizzard.

Alphabet, Google’s parent, posted better-than-expected revenue according to Refinitiv and reported a profit in its cloud business for the first time in history. However, the stock reversed its rise to a premarket 1% drop.

Other key earnings will be seen on Wednesday, before the market opens: Boeing, Humana, Hilton Worldwide, Spirit Airlines, Hess, Teck, Thermo Fisher, General Dynamics and Boston Scientific.

After the close of the regular trading session, it will be Meta Platforms’ turn to release earnings. The company is expected to report earnings per share of $2.12 on $31.80 billion in revenue.

Wall Street Corporate Highlights for Today

Alibaba (NYSE:BABA) – A group of nine Republican senators sent a letter to the Commerce, State and Treasury departments on Monday urging the Biden administration to impose sanctions on Chinese cloud service providers, specifically two of the biggest providers of cloud services from China, Huawei Cloud and Alibaba Cloud.

Activision Blizzard (NASDAQ:ATVI) – Microsoft’s $69 billion acquisition of Activision Blizzard Inc has taken a hit after the UK antitrust authority vetoed the industry’s biggest-ever gaming deal, saying it would undermine competition in the cloud gaming sector, in a move that could set the tone for the world’s biggest regulators.

Target (NYSE:TGT) – Target has started offering a curbside pickup service, Drive Up. The service, which began last week at about a quarter of Target’s nearly 2,000 stores nationwide, will be available across the chain by the end of the summer.

First Republic Bank (NYSE:FRC) – Regional bank shares fell 10% premarket, with the potential to again weigh on the broader banking sector. First Republic said on Monday that its deposits fell 40% to $104.5 billion in the first quarter, and the shares lost nearly half their value on Tuesday.

Amazon (NASDAQ:AMZN) – The e-commerce giant saw its shares rise 2.8% in premarket trading. The gain came after tech-related giant Microsoft posted quarterly earnings that beat expectations, boosting sentiment for Amazon. The company releases numbers Thursday after the close.

Coinbase (NASDAQ:COIN) – The cryptocurrency exchange was up 5% premarket, along with a jump in cryptocurrency prices, including Bitcoin’s 5% rise. HC Wainwright also began hedging Coinbase with a Buy rating and $75 price target, implying a 34% upside from Tuesday’s close.

ServiceNow (NYSE:NOW) – Shares of the digital workflow company gained 3.1% after falling more than 6% during Tuesday’s session when Infosys announced its collaboration with ServiceNow. ServiceNow will announce its quarterly earnings on the Wednesday after the bell.

Earnings

Microsoft (NASDAQ:MSFT) – Microsoft beat Wall Street expectations in its third-quarter earnings report, showing the early impact of its high-profile commitment to artificial intelligence since bolstering its investment in the company behind the chatbot viral ChatGPT. Shares are up 7.5% premarket.

Alphabet (NASDAQ:GOOGL) – Alphabet shares fell as much as 1% premarket as it reported first-quarter results that beat analyst estimates, posted a profit on its cloud business, and announced a $100 share buyback. 70 billion.

GlaxoSmithKline (NYSE:GSK) – GSK shares were up 0.24% premarket after it kicked off 2023 with a quarterly performance that beat analyst expectations and extended a run of positive results after strong selling. It reaffirmed its guidance for 2023, saying it expects adjusted operating profit growth to be higher in the second half.

Chipotle (NYSE:CMG) – Chipotle stock rose more than 7% premarket after the company reported quarterly earnings and revenue that beat analysts’ expectations, boosted by better-than-expected same-store sales growth.

PacWest Bancorp (NASDAQ:PACW) – PacWest stock rose more than 13% premarket after it said along with its first-quarter earnings report that total deposits rose to $28.2 billion on March 31 from $ 27.1 billion when the company provided an investor update on March 20. The company saw deposit balances grow by an estimated $700 million on April 24.

Texas Instruments (NASDAQ:TXN) – Texas Instruments Inc stock swung for a more than 2% premarket gain after the analog chip indicator gave Wall Street much better visibility into an expected market rally. Texas Instruments also reported net income of $1.71 billion, or $1.85 per share, in the first quarter, compared with $2.2 billion, or $2.35 per share, in the same period. of the previous year.

Enphase Energy (NASDAQ:ENPH) – Enphase shares fell more than 15% premarket when it reported first-quarter earnings that beat Wall Street expectations, but issued a lower-than-expected revenue outlook for the current quarter.

Visa (NYSE:V) – Visa rose 0.9% premarket as it announced a continued recovery in travel spending, posting fiscal second-quarter net income of $4.26 billion, or $2.03 per share. share, compared to $3.65 billion, or $1.70 per share, in the year-ago quarter.

Boeing (NYSE:BA) – Boeing shares rose about 4% premarket after reporting in first-quarter results that it lost $440 million, or $1.27 per share, compared with a net loss of $1.44 billion or $2.75 per share in the prior year. The company also said it plans to increase production of 737 Max planes to 38 per month from 31 at the end of this year, despite a manufacturing issue affecting some aircraft.

Thermo Fisher Scientific (NYSE:TMO) – Shares fell 3.9% after Thermo Fisher Scientific reported first-quarter earnings that were in line with expectations. The Massachusetts-based supplier of scientific instruments reported adjusted earnings per share of $5.03, in line with a StreetAccount estimate. Thermo Fisher Scientific beat revenue expectations, reporting revenue of $10.71 billion, higher than the estimate of $10.65 billion.