JPMorgan activates Tokenized Collateral Network (TCN) with historic transaction between BlackRock and Barclays

JPMorgan Chase (NYSE:JPM) has successfully launched Tokenized Collateral Network (TCN), its blockchain-based collateral settlement application, in a groundbreaking transaction involving BlackRock (NYSE:BLK) and Barclays (NYSE:BCS). TCN enables near-instant conversion and transfer of tokenized assets, revolutionizing collateral settlement and signaling a challenge to traditional systems. The bank plans to expand the TCN to cover a wider range of assets, increasing market efficiency and highlighting the growing role of private banks in blockchain technology.

Jim Cramer expresses pessimism about Bitcoin

Jim Cramer, former hedge fund manager and host of CNBC’s Mad Money, expressed his skepticism towards Bitcoin (COIN:BTCUSD), stating “I can’t go out with gold because gold is not good; I can’t go out with bitcoin because I can’t be in something where Mr. Bitcoin is about to go down big”. Despite his pessimistic outlook, the cryptocurrency is still up 68% year to date. Cramer had already sold his Bitcoin holdings in 2021. Meanwhile, hedge fund billionaire Paul Tudor Jones has expressed his support for both Bitcoin and gold due to US debt and geopolitical concerns.

Ethereum price could reach $8,000 by 2026, says Standard Chartered Bank

Standard Chartered Bank (LSE:STAN) predicts that the price of Ethereum (COIN:ETHUSD) could reach $8,000 by the end of 2026, driven by Ethereum’s dominance in smart contracts, gaming and tokenization. Geoffrey Kendrick, head of forex and crypto research at the bank, believes this price is an initial step towards long-term structural valuation, which ranges from $26,000 to $35,000. Kendrick also predicts that the upcoming Bitcoin halving in 2024 and regulation in the US will benefit Ethereum, boosting its price to around $4,000 by the end of 2024.

NASAA supports SEC legal action against Coinbase

The North American Securities Administrators Association (NASAA) supports the U.S. Securities and Exchange Commission (SEC) in its legal action against Coinbase (NASDAQ:COIN). NASAA argues that while cryptocurrencies themselves are not inherently fraudulent, fraudsters exploit investor fear and economic circumstances. The association defends the SEC’s consistency regarding industry regulation and urges the court to reject Coinbase’s arguments regarding the interpretation of securities laws.

Bitfinex parent iFinex announces $150 million share buyback in response to regulatory challenges

iFinex, the parent company of Bitfinex, plans to repurchase shares worth US$150 million, equivalent to around 9% of the company’s working capital. This strategy aims to increase control over private trading and simplify the ownership structure, in response to recent regulatory challenges. The buyback is part of a strategy to navigate the ever-changing regulatory landscape while ensuring operational autonomy.

Digital asset bank Xapo obtains broker license to trade S&P 500 shares in Europe

Gibraltar-based company Xapo has gained a securities broker license, expanding its offering to include S&P 500 share trading as well as crypto asset management services. Xapo focuses on long-term investors and seeks to create diversified portfolios, combining cryptocurrencies with stocks and savings accounts. The company also plans to add Ethereum (COIN:ETHUSD) to its offering, moving beyond its exclusive focus on Bitcoin (COIN:BTCUSD).

WOO recovers tokens and shares from Three Arrows Capital after bankruptcy

Cryptocurrency exchange WOO has successfully recovered shares and tokens acquired from failed hedge fund Three Arrows Capital (3AC). 3AC was the largest investor in WOO’s Series A funding round. The deal involved the buyback and burn of 20 million tokens, eliminating uncertainty in the WOO ecosystem. WOO co-founder Jack Tan highlighted the focus on rebuilding the ecosystem and a future of growth. “ The last 18 months have seen a concentration of bad news hit our industry, from large-scale failures to more zealous regulators. A complete cleanup of the system has taken place and we look forward to rebuilding it with our partners and team”, said Tan. The news came after the arrest of Su Zhu, co-founder of 3AC, in Singapore.

Former CEO of Alameda Research confesses in SBF trial

On the sixth day of the Sam “SBF” Bankman-Fried trial in New York, former Alameda Research CEO Caroline Ellison confessed to submitting false numbers to Genesis. She alleged that SBF instructed her to create “alternative” balance sheets regarding Alameda’s use of FTX funds, highlighting FTX’s $10 billion in loans. Ellison expressed concerns about FTX withdrawing customers and admitted her actions were “dishonest” and “wrong.” “ I was worried about the withdrawal of clients from FTX, this exit, people getting hurt […] I didn’t feel good. If people found out [about Alameda using FTX funds], they would all try to withdraw from FTX”. In posts revealed during his trial, Sam Bankman-Fried admitted considering closing Alameda in 2022 due to concerns about the relationship between the two companies. He blamed the spread of FUD (Fear, Uncertainty, Doubt) by FTX’s competitors. Bankman-Fried planned to maintain Alameda as an infrastructure investment and development company, but without active trading.

OKX integrates wallet with Aftermath Finance to access decentralized DeFi

OKX, a leader in Web3 technology, announced that its wallet is now integrated with Aftermath Finance, allowing users to access liquidity pools, farm and decentralized bridge solutions. The OKX wallet offers access to 70+ blockchains and MPC technology for enhanced security. Additionally, OKX Wallet smart account allows payments across multiple blockchains using USDC or USDT.

Immutable and Amazon Web Services collaborate to power blockchain gaming

Immutable, a blockchain gaming platform, has entered into a strategic partnership with Amazon Web Services (AWS) to strengthen the web3 gaming ecosystem. Through this partnership, Immutable will have access to AWS resources and offer up to $100,000 in AWS credits to game studios, advancing the blockchain technology revolution in the gaming industry. Immutable plans to expand its offerings and partner support in the future with the Ethereum-compatible Immutable zkEVM.

Io.net turns GPU resources into affordable AI computing power

Io.net, originally a quantitative trading platform, has now become a decentralized network offering affordable GPU computing power for AI and machine learning. By aggregating GPU resources from data centers, cryptocurrency miners, and decentralized storage providers, Io.net seeks to drastically reduce costs compared to centralized alternatives. The network leverages the Solana blockchain and will introduce native tokens to reward miners and facilitate access to affordable AI computing.

Circle and Coins.ph team up to facilitate remittances in the Philippines with USDC

Circle (COIN:USDCUSD) announced a strategic partnership with Coins.ph, a cryptocurrency exchange in the Philippines. The collaboration aims to raise awareness about USDC payments by making international money transfers more accessible and faster. The initiative seeks to improve remittances in the Philippines, one of the largest global recipients of remittances, especially for the unbanked population.

Bitstamp plans return to Canadian market after temporary shutdown

Bitstamp, one of the oldest cryptocurrency exchanges, will end its services in Canada in January 2024, but plans to return in the future. The decision to exit the Canadian market is temporary and based on the company’s expansion priorities. Bitstamp will continue to focus on serving its global user base, depending on evolving regulatory and market conditions. Currently, the exchange serves several countries, including the United States, South Korea and Japan.

UK committee recommends collaboration with NFT marketplaces to combat copyright infringement

A UK cross-party committee has called on the government to work with markets for non-fungible tokens (NFTs) to address copyright infringement. Additionally, the committee expressed concerns about the release of tokens by UK football clubs, warning of financial risks to fans. The Financial Conduct Authority (FCA) recently implemented new rules for crypto companies, requiring registration and approval of marketing materials, and companies are expected to comply with the “basic rules” from October 8th. Exchanges including Coinbase, Revolut and Binance have updated their mobile and web apps to comply with the new regulations.

Central Bank of Nigeria defends eNaira project after concerns over financial stability

The Central Bank of Nigeria (CBN) has reacted to recent concerns about financial stability, stating that its digital currency project, the eNaira, does not pose a threat. The CBN responded to allegations in the media by emphasizing its in-depth understanding of central bank digital currencies (CBDCs) and highlighting the aim of improving the user experience with eNaira. The survey also revealed that Nigeria has a highly cryptocurrency-aware population compared to other global economies.

India collects $12 million in 1% tax on crypto transactions

India’s Central Board of Direct Taxes (CBDT) has revealed that it has collected over $12 million in Tax Deducted at Source (TDS) from crypto transactions this fiscal year. The Indian government introduced a 1% direct tax on such transactions in July 2021. While the country’s crypto regulations remain uncertain, the government has been implementing tax measures to curb the unregulated adoption of cryptocurrencies.

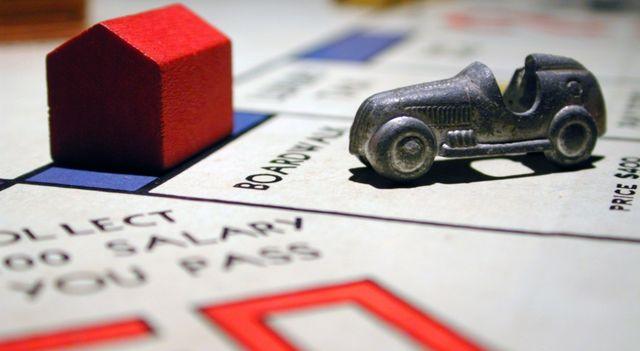

New edition of Monopoly introduces Ethereum cryptocurrency

According to news site Cryptonews, MONOPOLY: World of Women (WoW) Galaxy Edition, a new edition of Monopoly, will incorporate cryptographic elements, with Ethereum (COIN:ETHUSD) replacing traditional money. The game, with custom golden tokens honoring Web3 communities, will launch on October 17, under license from Hasbro (NASDAQ:HAS), featuring a decentralized economy. Yam Karkai, co-founder and creative director of World of Women, led the creative direction of the project.