In a note released Wednesday, Bank of America analysts suggested that quantum computing “could be the biggest revolution for humanity since discovering fire.”

They argued that this groundbreaking technology has the potential to upend existing global power structures and spark an era of extraordinary innovation.

“A human would have to perform one sum every second for c.50 quintillion years to equal what a quantum computer can do in a single second,” BofA highlighted.

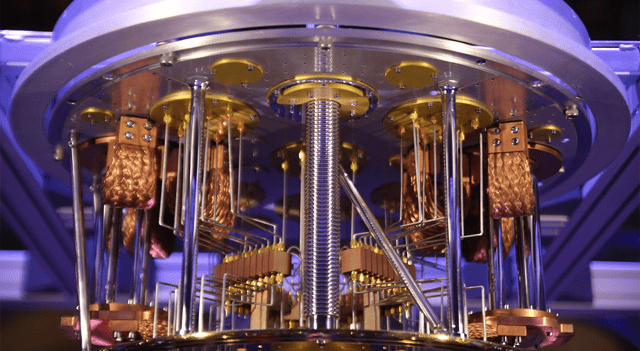

The analysts portrayed quantum computing as “a technology that can perform endless complex calculations in zero-time, warp-speeding human knowledge and development.”

Although quantum systems are still prone to errors and have yet to achieve full advantage, BofA believes the technology is nearing maturity, with widespread practical use expected between 2030 and 2033.

“The challenge is to increase the qubit number and quality,” they said, pointing to advancements in next-gen chips and enhanced qubit fidelity as key.

BofA estimates the quantum computing application market could be worth $2 trillion by 2035, though it cautioned that “the real number could be global GDP,” considering quantum’s potential to revolutionize encryption, drug discovery, logistics, deep learning, and material sciences.

Significantly, the fusion of quantum computing with generative AI might produce what BofA calls “Artificial Super Intelligence.” The bank explained, “A QC with just 10 qubits could perform 100x more operations than a classical computer,” making it perfect for speeding up generative AI training.

They also warned, “whoever wins the ‘quantum race’ will gain an unprecedented geopolitical, technological and economic advantage.”

Government funding for quantum research is accelerating rapidly, with more than $42 billion pledged worldwide. China alone accounts for 35% of that investment, highlighting the intense competition at this frontier.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.