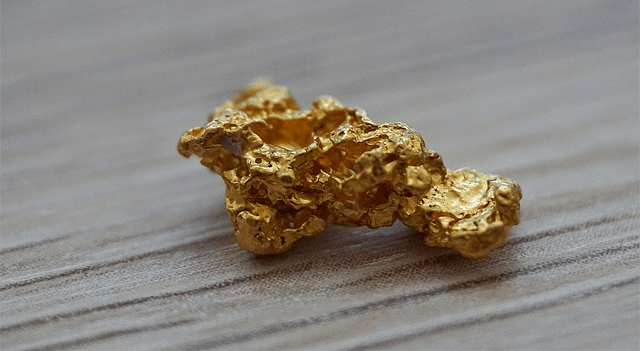

Gold prices slid on Monday amid warnings from Bank of America that further weakness could set off automatic selling by commodity trading advisors (CTAs). The metal has been facing persistent downside pressure, with prices approaching levels that could activate stop-loss mechanisms used by trend-based trading systems.

Bank of America’s analysts believe that many trend-following investors continue to hold large long positions in gold. Their modeling suggests that “an additional 1% to 3.5% decline in gold futures prices could accelerate stop-loss selling as these algorithmic traders exit positions to limit losses.”

Beyond the gold market, Bank of America’s commodity outlook pointed to contrasting trends in copper trading. The bank expects more buying activity in CME copper futures from long-term trend followers, while London Metal Exchange contracts are likely to face selling. This divergence illustrates regional shifts in sentiment and trading behavior across metals markets.

Agricultural commodities also drew attention, particularly soy derivatives. The bank described soybean oil positioning as “stretched long” and soybean meal as “stretched short,” indicating the potential for price swings as market participants adjust positions.

Of particular note, Bank of America sees soybean meal as a candidate for a sharp upside move if sentiment reverses. A potential rally could be fueled by CTA short-covering, as the bank highlighted the possibility of a “significant move higher” in response to a bullish turn.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.