Shares of Eaton Corporation plc (NYSE:ETN) dropped 6.4% on Tuesday, as investors reacted negatively to the company’s third-quarter earnings forecast, even as the power management firm posted record second-quarter results that beat expectations.

Eaton reported adjusted earnings per share of $2.95 for Q2, narrowly surpassing the analyst estimate of $2.93. Revenue hit an all-time quarterly high of $7.03 billion, exceeding forecasts of $6.91 billion. The company achieved 8% organic sales growth, landing at the top of its projected range, with total revenue rising 11% from the year-ago quarter. This included contributions of 2% from acquisitions and 1% from favorable currency exchange.

Segment margins also hit a Q2 record at 23.9%, reflecting operational efficiency across key divisions.

Despite these strong results, the company’s guidance for the third quarter underwhelmed investors. Eaton projected adjusted EPS of $3.01 to $3.07, falling short of the $3.10 analysts had expected.

For the full year 2025, the company reiterated its forecast of adjusted EPS between $11.97 and $12.17, representing 12% growth at the midpoint compared to 2024 — broadly in line with Wall Street expectations.

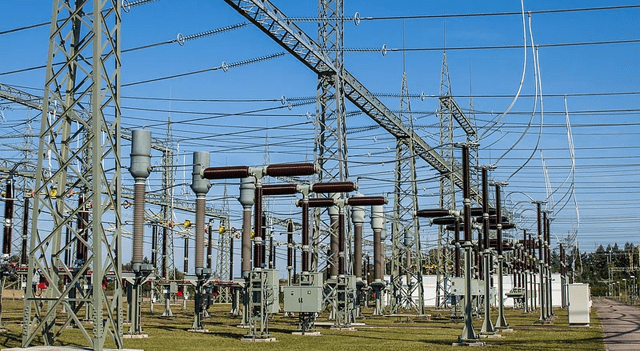

“I’m proud to share Eaton’s strong second quarter results, reflecting our team’s commitment to leading and executing on our strategy to become the world’s premier power management company,” said Paulo Ruiz, Eaton’s chief executive officer. “We see sustained demand in the acceleration of orders and increase in our backlog, powering our organic growth.”

By segment, Electrical Americas stood out with record revenue of $3.4 billion, a 16% year-over-year increase. The Aerospace division also posted a record with $1.1 billion in sales, up 13%. Both segments showed strong backlog growth, with Electrical Americas up 17% and Aerospace up 16% compared to June 2024.

Looking ahead, Eaton expects full-year organic growth of 8.5% to 9.5%, while guiding for segment margins between 24.1% and 24.5%.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.