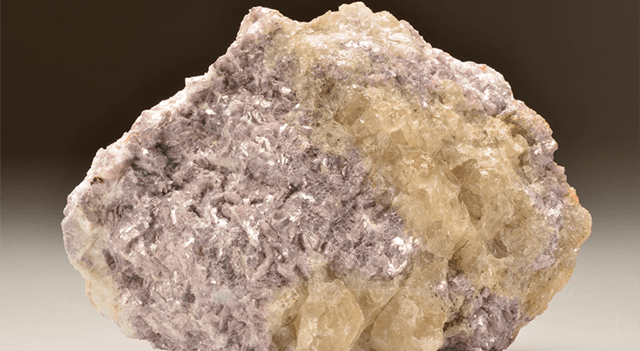

UBS has revised its lithium price projections upward following the suspension of mining activities by CATL at its Jianxiawo lepidolite site in China, intensifying supply concerns amid heightened regulatory oversight.

Operations were halted after CATL’s mining license expired on August 9, with the company indicating the shutdown would last “at least 3 months,” according to a UBS research note released Monday.

The suspension comes in the context of China’s ongoing anti-involution campaign, which has targeted irregularities in mining licenses and production levels exceeding approved limits.

UBS previously estimated that, in addition to the already suspended 11,000 tons per year of lithium carbonate equivalent (LCE) from Zangge Mining, as much as 229,000 tons of supply could be at risk due to non-compliant licenses.

In response to these developments, the bank has increased its price forecasts for spodumene by 16–27% and for lithium chemicals — carbonate and hydroxide — by 5–14% for the 2025–2028 period.

UBS stated it now believes “the worst of the lithium price downcycle has passed,” though its estimates still sit below market consensus.

The bank also adjusted its expected supply growth from Australian producers after quarterly earnings, while pushing back the projected start date for Rio Tinto’s (NYSE:RIO) James Bay project from the original 2025/26 schedule.

On the demand side, global electric vehicle sales rose 26% year-over-year in June, with China leading at 31% growth. Chinese manufacturers now account for roughly 64% of worldwide EV sales.

While North America posted a decline in EV sales, Europe’s market expanded by 26% year-over-year in June, and the Asia Pacific region excluding China surged 55%.

Battery energy storage systems (BESS) are also seeing rapid expansion, with the global project pipeline up 115% year-over-year, representing about 1.6 TWh of planned capacity for 2025–2030.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.