Bath & Body Works, Inc. (NYSE:BBWI) reported second-quarter results on Thursday that met revenue expectations but missed slightly on earnings, sending its shares down 1.68% in premarket trading.

The retailer, known for its home fragrance and personal care products, posted adjusted EPS of $0.37—just below analysts’ consensus of $0.38. Revenue came in at $1.55 billion, matching Wall Street forecasts and representing a 1.5% year-over-year increase. Both figures landed at the high end of the company’s own guidance range.

“Our team delivered a solid quarter, with revenue and adjusted earnings per share at the high end of our guidance range,” said Daniel Heaf, CEO of Bath & Body Works. “Based on our strong first-half results and our confidence in our outlook, we are raising the low end of our full-year adjusted earnings per share guidance range.”

For fiscal 2025, the company lifted the lower bound of its adjusted EPS guidance to $3.35 from $3.25, maintaining the upper end at $3.60. Analysts were expecting $3.48. However, the company’s third-quarter outlook of $0.37–$0.45 per share fell short of the $0.49 consensus, a factor that weighed on the stock.

Bath & Body Works also narrowed its full-year revenue growth forecast to 1.5%–2.7%, compared with its prior outlook of 1%–3%. In addition, management boosted its planned share buyback program from $300 million to $400 million.

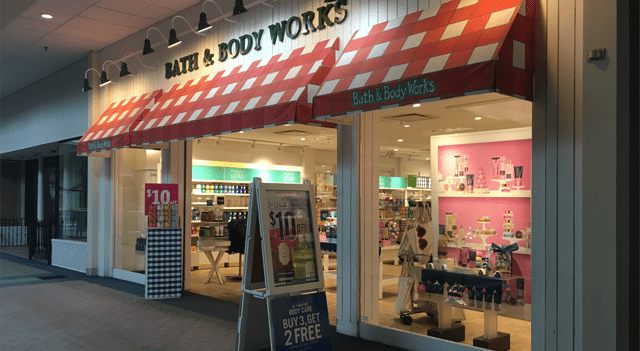

The company continues to prioritize strategic initiatives, including enhancing its digital platform, improving product performance, and broadening its distribution network. As of August 2, 2025, it operated 1,904 stores across the U.S. and Canada, along with 537 international franchised locations.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.