A1R WATER, a global innovator in atmospheric water generation, announced that it has entered into a definitive agreement to merge with special purpose acquisition company Inflection Point Acquisition Corp. III (NASDAQ:IPCX). The transaction will result in the combined company being named Air Water Ventures Limited, with shares expected to trade on Nasdaq under the ticker “WATR”.

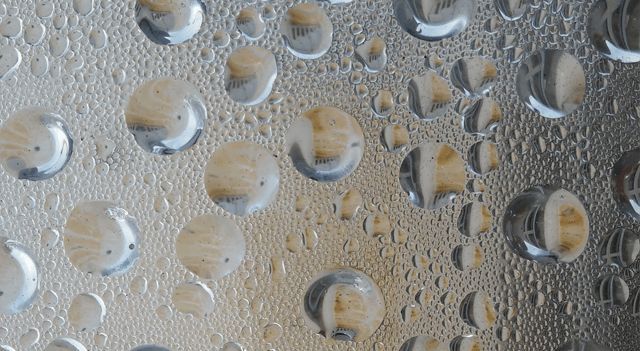

Founded in 2018, A1R WATER has transformed traditional dehumidification methods into commercial-scale water production, with over 30 million gallons of BPA- and microplastic-free water projected for 2025. Unlike conventional water sources that rely on desalination and groundwater treatment, A1R WATER harnesses humidity in the air, offering a scalable, sustainable alternative as global freshwater demand is forecast to outstrip supply by 40% within five years.

The company has already established a strong presence in the UAE, generating over 60 million gallons annually for hotels, office complexes, and events since January 2024. Building on this success, A1R WATER is expanding into the U.S., with its first American water farm in Fort Lauderdale operational in 2025. Strategic partnerships include a collaboration with the Miami HEAT, alongside the launch of its full product line from consumer countertop units to industrial systems capable of producing 3,000 liters per day.

“A1R WATER has made incredible progress over the past few years, particularly in proving out our proprietary technology, asset mix and ability to scale,” said Peter Carr, Chief Executive Officer of A1R WATER. “The vastness of the problem we are confronting is humbling. But A1R WATER sits at an inimitable flashpoint at the intersection of need, technological advancement, consumer non-durable demand and branding. Our partnership with Inflection Point provides not only crucial capital, but a true strategic partner with an enviable track record of success. We look forward to working alongside their team to make A1R WATER a household name – in both the consumer product and clean technology industries.”

“Inflection Point has a proven history of investing in strategically important assets in rapidly growing markets,” said Michael Blitzer, Chairman of Inflection Point Asset Management. “We’re pleased to be joined by our industry-leading co-investors, including Southern Glazer’s Wine and Spirits and the Royal Group of Abu Dhabi, in facilitating A1R WATER’s continued success in commercializing their proprietary technology, providing critical sustainable solutions for government and commercial customers, and establishing a new segment in the consumer beverage industry.”

The merger carries a pro forma enterprise value of $419 million, with A1R WATER’s pre-money valuation set at $300 million. The deal includes a fully committed $63.5 million PIPE investment, led by Inflection Point, existing A1R WATER investors, and strategic partners including SG Ventures. Existing A1R WATER shareholders are expected to hold approximately 62.6% of the combined entity upon closing.

The transaction is anticipated to close by the end of Q1 2026, subject to customary regulatory and shareholder approvals.

About A1R WATER

A1R WATER designs and manufactures air-to-water technology capable of producing clean water from humidity in the air. Its systems range from consumer countertop units to industrial-scale water farms. The company operates its own water farms and bottling facilities, serving global brands such as Conrad Abu Dhabi, Fairmont Hotels & Resorts, Le Meridien, and the Miami HEAT.

About Inflection Point Acquisition Corp. III

Inflection Point is a Nasdaq-listed SPAC led by Wall Street veteran Michael Blitzer, focusing on strategic acquisitions in high-growth sectors. Previous mergers include Intuitive Machines, Inc. and USA Rare Earth, Inc., highlighting the firm’s track record of successfully launching well-capitalized public companies.

For more information, visit A1R WATER and Inflection Point.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.