Shares of Bloom Energy Corp. (NYSE:BE) surged 8% Tuesday morning following a major price target upgrade from Morgan Stanley, driven by the company’s expanding role in powering AI data centers.

Analyst David Arcaro boosted his price target on Bloom Energy from $44 to $85, maintaining an Overweight rating. The revised target implies significant upside from Monday’s close at $67 and now stands as the highest on Wall Street.

Arcaro cited Oracle’s (NYSE:ORCL) recent announcement of record bookings, with a sequential backlog increase of $317 billion, reaching nearly $0.5 trillion. This comes shortly after Bloom agreed in July to supply fuel cells for Oracle AI data centers.

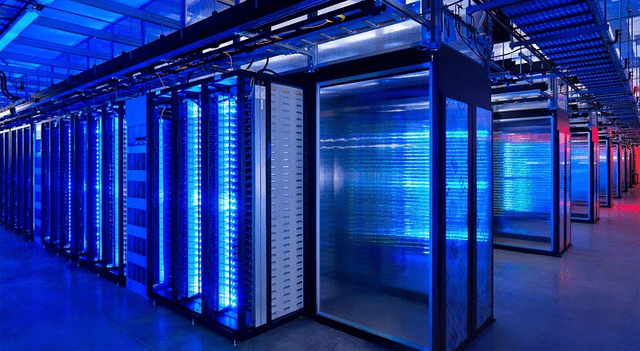

He said Bloom is now “favorably positioned for success in powering AI data centers” amid surging demand for data center power, noting that supply is tightening rapidly with both grid and alternative solutions experiencing extended delays.

A major strength for Bloom lies in its manufacturing agility, capable of doubling capacity in under six months and delivering products quickly. Arcaro emphasized that the projected power shortfall exceeds 40 GW in the coming years, compared with Bloom’s current 1 GW annual production, presenting substantial growth potential.

The analyst also increased his bull case to $185, suggesting Bloom could become “a much bigger player in the power landscape.” He added that every 50 MW of recurring demand—representing just 5% of current manufacturing capacity—translates to roughly $5 per share in value for the stock.

Traditional utility providers are struggling to meet demand, with some reporting 5-7 year waits to connect new data centers to the grid, further bolstering Bloom’s competitive edge.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.