Alibaba Group (NYSE:BABA) shares jumped Wednesday after the Chinese e-commerce titan unveiled plans to significantly boost spending on artificial intelligence infrastructure and revealed a new collaboration with AI powerhouse Nvidia (NASDAQ:NVDA).

As of 8:44 AM ET, Alibaba ADRs traded in the U.S. were up 8.9% at $177.70, while shares listed in Hong Kong climbed 9.2% to HK$174.00, reaching their highest level in nearly four years.

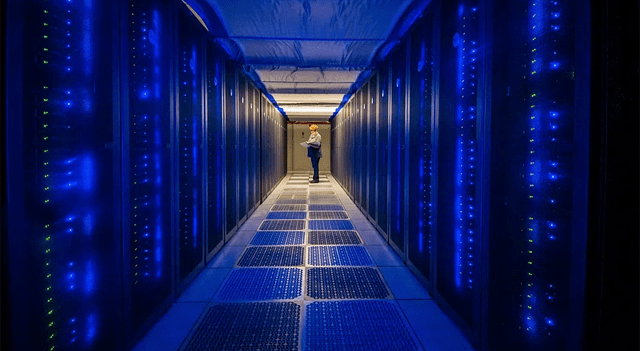

The company outlined plans to launch its first data centers in France, the Netherlands, and Brazil, with additional facilities coming online in Dubai, Malaysia, South Korea, Mexico, and Japan. This expansion will extend Alibaba’s global AI footprint to 29 regions. Earlier this year, the firm pledged 380 billion yuan (roughly $53.4 billion) in AI infrastructure investment over three years, and CEO Eddie Wu suggested spending could increase further, though no specific figure was announced.

At Alibaba’s annual conference, the company introduced Qwen3-Max, a language model with over 1 trillion parameters designed to excel at code generation and autonomous agent tasks, according to CFO Zhou Jingren. Alibaba also presented Qwen3-Omni, a multimodal system tailored for immersive applications such as virtual reality and intelligent vehicle interfaces.

Additionally, the company confirmed a partnership with Nvidia to enhance AI capabilities in areas like data synthesis, environmental simulations, reinforcement learning, and model training. Following the announcements, BofA Securities raised its price target on Alibaba ADRs to $195 from $168.

“Eyeing the huge opportunity in the new ASI era, the company positions itself as a world’s leading full-stack AI services provider to offer best-class large models, global AI cloud network, as well as open and developer friendly ecosystem,” said analyst Joyce Ju, reiterating a Buy rating on the stock.

Alibaba Group Holdings stock price

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.