Shares of Lithium Americas Corp (NYSE:LAC) soared 58% on Wednesday after news surfaced that the U.S. government is exploring taking an equity stake in the lithium producer.

The sharp rise in the stock price follows reports that federal officials are renegotiating the terms of a previously announced $2.3 billion loan. The original loan, aimed at boosting domestic production of critical minerals, is now being restructured to potentially include direct government ownership.

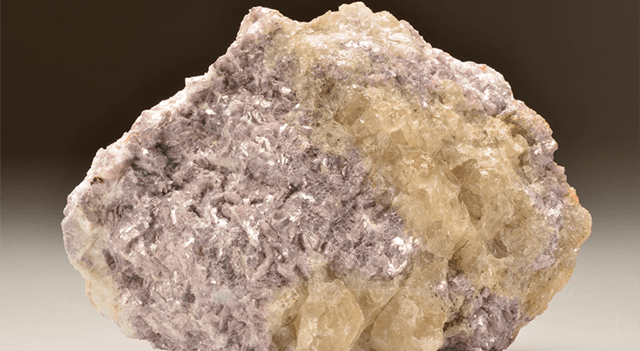

Lithium Americas, developing the Thacker Pass lithium project in Nevada, is collaborating with the U.S. government to finalize funding arrangements for what could become one of the largest lithium operations in the country. The Thacker Pass site is estimated to host one of the nation’s largest lithium deposits.

The $2.3 billion loan was initially unveiled as part of the Biden administration’s effort to secure domestic supply chains for critical minerals used in electric vehicle batteries and renewable energy storage. Lithium is regarded as a strategic resource because of its crucial role in the transition to clean energy technologies.

The potential government equity stake signals a notable shift in strategy, moving beyond loans toward direct ownership of key mining assets. Following the announcement, trading volume for Lithium Americas stock surged to more than ten times the daily average.

Lithium Americas Corp stock price

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.