Oil prices eased in Asian trade on Thursday, retreating from the seven-week highs hit in the previous session as investors locked in profits amid expectations of slower demand during the winter and the return of Kurdish crude supplies.

Brent futures fell 19 cents, or 0.3%, to $69.12 a barrel by 0637 GMT, while U.S. West Texas Intermediate (WTI) crude lost 22 cents, or 0.3%, to $64.77 a barrel. Both benchmarks had surged 2.5% on Wednesday, reaching their strongest levels since August 1, driven by a surprise drop in U.S. crude inventories and concerns over potential disruptions from Ukraine’s attacks on Russian energy infrastructure.

“Oil prices are hovering above our expectations,” said Suvro Sarkar, the energy sector team lead at DBS Bank. “We would expect profit-taking to emerge at current levels and oil prices to slowly moderate hereon as we enter the slower winter demand season.”

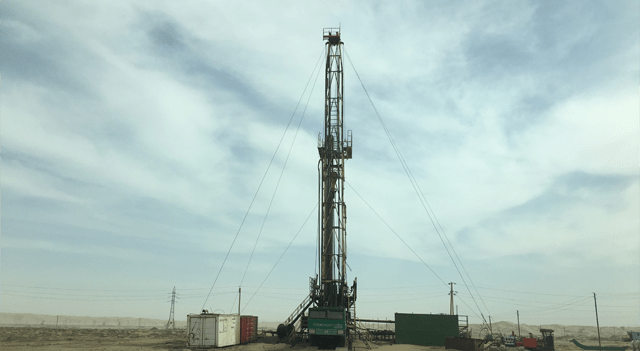

Further pressure came from supply expectations, with Iraqi and Kurdish output set to increase in the near term.

“The return of Kurdish supplies adds back fears of an oversupply narrative, propelling a pullback in prices that hover near a seven-week high,” said Priyanka Sachdeva, senior market analyst at Phillip Nova. Oil exports from Iraqi Kurdistan are expected to resume shortly, following a deal reached on Wednesday between eight oil firms and Iraq’s federal and Kurdish regional governments.

While concerns over Russian supply remain, Haitong Securities noted that oil prices have been supported by the lack of substantial downward pressure from supply–demand fundamentals in recent weeks. As peak demand eases, prices have yet to fully reflect the potential for oversupply.

Investor caution on demand was highlighted by J.P. Morgan analysts, who reported on Wednesday that U.S. air passenger traffic in September rose only 0.2% year-on-year, a slowdown from the 1% growth in the previous two months.

“Likewise, U.S. gasoline demand has started to pull back, mirroring the broader moderation in travel trends,” the analysts said.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.