Envoy Medical Inc. (NASDAQ:COCH) shares plunged 37.8% in premarket trading Wednesday after the hearing health company announced a $4 million registered direct offering, raising investor concerns over shareholder dilution.

The company said it had entered into definitive agreements to sell approximately 3 million Class A common shares at $1.33 per share, in a deal priced at-the-market under Nasdaq rules. The offering is expected to generate about $4 million in gross proceeds before fees and expenses.

Alongside the share sale, Envoy will issue unregistered warrants to purchase up to 9,022,572 additional Class A shares in a concurrent private placement. These warrants will carry an exercise price of $1.33 per share, be immediately exercisable, and expire 24 months after the effective date of the related registration statement.

H.C. Wainwright & Co. is acting as the exclusive placement agent for the transaction, which is expected to close around October 9, 2025.

If all warrants are exercised in full for cash, Envoy could raise up to an additional $12 million in gross proceeds, though the company cautioned that there is no guarantee any warrants will be exercised.

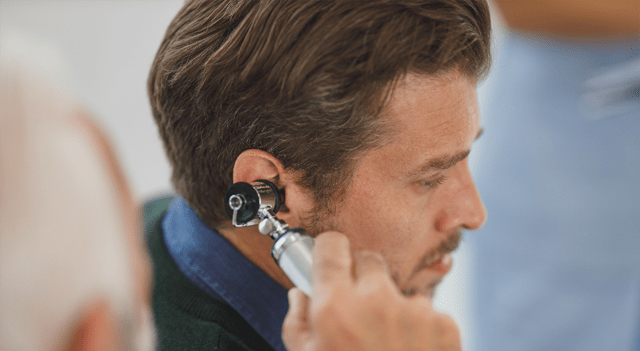

Envoy, which specializes in fully implanted hearing technologies, said it plans to use the net proceeds from the offering for working capital and general corporate purposes as it continues advancing its implantable hearing solutions pipeline.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.