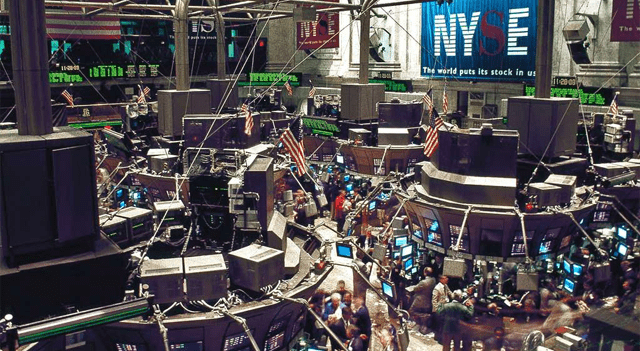

Pre-market sentiment was predominantly positive on US stock markets, suggesting an environment of moderate confidence among investors.

On the NYSE , about 55% of stocks, or 1,036 companies, rose, while 551, or about 29%, fell, and 265 remained flat.

On the Nasdaq , the outlook also showed a slight upward bias. Approximately 53% of listed companies, or 1,789 companies, were trading in the green, compared with 1,254 (nearly 37%) in decline and 294 unchanged.

Largest NYSE premarket swings

The three biggest premarket gainers on the NYSE were led by Canadian graphite miner Nouveau Monde Graphite Inc (NYSE:NMG), which surged 14.53%. Close behind, semiconductor maker Wolfspeed Inc (NYSE:WOLF) posted an 11.99% gain, while biopharmaceutical Annovis Bio Inc (NYSE:ANVS) surged 10.13% following positive clinical trial news.

The steepest declines were at Italian sports car maker Ferrari NV (NYSE:RACE), which fell 12.51% after lower-than-expected quarterly results. Metals and galvanizing manufacturer AZZ Inc (NYSE:AZZ) fell 12.03%, and real estate developer St. Joe Company (NYSE:JOE) lost 10.50% premarket.

Nasdaq’s biggest premarket swings

The three biggest premarket gainers on Nasdaq were led by rapid diagnostic test developer Bluejay Diagnostics Inc (NASDAQ:BJDX), which soared 102.14%. Next, Chinese digital advertising company Baosheng Media Group Holdings Ltd (NASDAQ:BAOS) surged 44.12%, while biopharmaceutical company Galecto Inc (NASDAQ:GLTO), focused on fibrosis and cancer therapies, surged 43.00%.

The biggest declines on the Nasdaq were recorded by Chinese pharmaceutical company Universe Pharmaceuticals Inc (NASDAQ:UPC), which plummeted 33.40%. Technology and online services company Lucas GC Ltd (NASDAQ:LGCL) fell 30.02%, followed by investment company AlphaTON Capital Corporation (NASDAQ:ATON), which fell 25.66%.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.