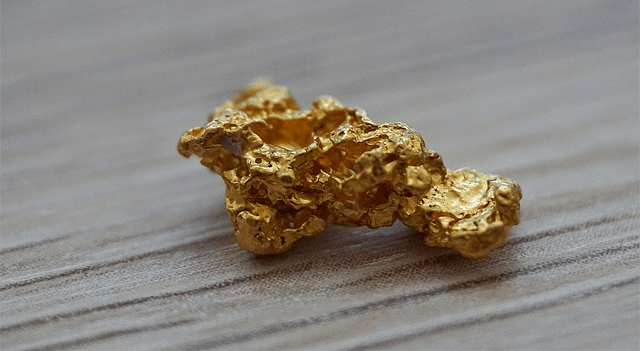

Gold prices soared to a fresh all-time high in Asian trading on Wednesday, extending a powerful rally fueled by growing expectations of U.S. interest rate cuts and renewed friction between Washington and Beijing. Investors piled into the safe-haven metal for a third consecutive session, pushing it closer to the $4,200 per ounce mark.

Spot gold rose 1.1% to $4,186.84 an ounce as of 02:05 ET (06:05 GMT), after touching a record $4,193.6 earlier in the day. U.S. December Gold Futures were up 1% at $4,203.27. The metal has now notched gains for eight straight weeks and looks set for another strong weekly close if current levels hold.

Fed signals ease, trade tensions flare

Momentum accelerated after Federal Reserve Chair Jerome Powell struck a dovish tone on Tuesday. Powell said the U.S. economy may be on a firmer trajectory than some expected, but cautioned that a notably softer labor market is emerging. He added that there was “no risk-free path” for policy and emphasized that future decisions would be made “meeting by meeting.”

Those comments reinforced market expectations for rate cuts in October and December, which sent Treasury yields lower and weighed on the dollar — typically bullish factors for non-yielding assets like gold.

Heightened trade tensions also lifted the metal. President Donald Trump floated the possibility of severing certain trade links with China, particularly on cooking oil imports, in response to Beijing’s reduced U.S. soybean purchases. The standoff deepened after both countries imposed reciprocal port fees on shipping companies earlier in the week.

“Gold and silver are two of the best-performing commodities this year, with prices up by more than 55% and 80% YTD, respectively, supported by the Fed’s policy easing, the central bank’s purchases and geopolitical tensions, which have fuelled demand for safe-haven assets,” ING analysts said in a recent note.

Broader metals rally as dollar weakens

The rally was not limited to gold. Silver advanced 1.4% to $52.12 per ounce, extending gains after setting a record at $53.6 in the prior session. Platinum Futures climbed 1.4% to $1,687.20 an ounce.

On the base metals front, benchmark Copper Futures on the London Metal Exchange added 0.7% to $10,667.50 a ton, while U.S. Copper Futures rose 0.8% to $5.04 a pound.

New inflation data from China showed consumer prices fell 0.3% year-on-year in September, compared with a 0.4% drop in August. Producer prices declined 2.3% from the prior year, easing from a 2.9% fall the previous month.

The soft inflation figures underscore persistent deflationary pressures in the world’s second-largest economy, boosting expectations for additional stimulus measures to support growth in the months ahead.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.