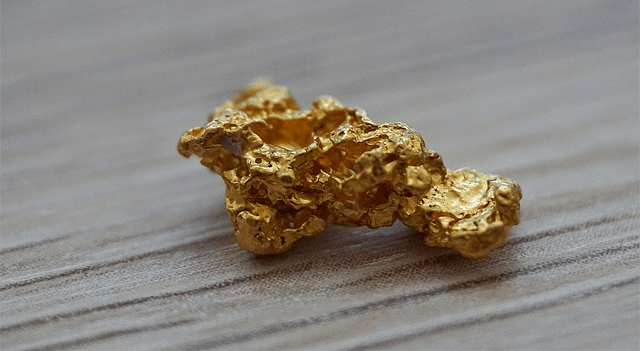

Gold prices were little changed on Wednesday, hovering close to three-week lows, as easing U.S.-China trade tensions and anticipation of a Federal Reserve rate decision kept investors on the sidelines.

At 01:40 ET (05:40 GMT), spot gold was up 0.2% to $3,957.42 per ounce, while U.S. gold futures edged down 0.1% to $3,977.76. The metal has dropped sharply over the past two sessions, reaching its weakest level since early October amid reduced safe-haven demand.

Fed decision in the spotlight

Markets are widely expecting the Federal Reserve to announce a 25-basis-point rate cut at the conclusion of its two-day meeting later Wednesday.

However, investors are paying closer attention to Fed Chair Jerome Powell’s comments on the outlook for future policy moves. If Powell suggests that further cuts are unlikely in the near term or highlights inflation risks, higher real yields and a firmer dollar could weigh further on bullion prices.

Trade optimism limits safe-haven appeal

Signs of progress in trade relations between Washington and Beijing have also pressured gold. Reports of a framework agreement addressing tariffs and rare-earth export restrictions have eased concerns of an escalating dispute.

Adding to the optimism, U.S. President Donald Trump said he plans to lower the 20% tariff on Chinese imports tied to fentanyl precursor chemicals before his summit with President Xi Jinping in South Korea on Thursday.

Trump arrived in Gyeongju, South Korea, on Wednesday following a visit to Tokyo, where he will meet South Korean President Lee Jae Myung to discuss regional cooperation and trade.

These developments have cooled demand for defensive assets such as gold, as traders grow more confident in the global economic outlook.

Other metals muted before Fed outcome

Activity in the broader metals market was subdued ahead of the Fed announcement. Silver futures gained 0.3% to $47.45 per ounce, while platinum futures fell 0.6% to $1,575.80.

Among industrial metals, benchmark copper on the London Metal Exchange rose 0.2% to $11,053.20 per ton, and U.S. copper futures added 0.3% to $5.18 per pound.

While expectations for a rate cut support the outlook for gold, improving risk sentiment and optimism over trade negotiations are keeping prices under pressure, suggesting the metal may remain range-bound in the short term.