UBS has boosted its price forecasts for palladium and platinum, pointing to stronger U.S. demand and growing market tightness fueled by supply uncertainties and potential trade restrictions.

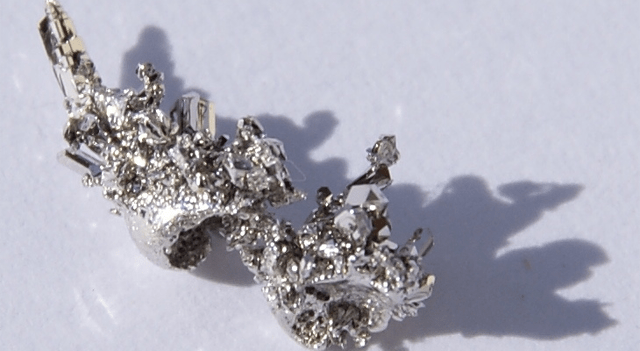

Palladium, which had trailed other precious metals for much of the year, saw a notable rebound in October. UBS strategists Giovanni Staunovo and Wayne Gordon lifted their forecast for the metal by $250 per ounce across all maturities to $1,350, citing persistent demand from the U.S. despite palladium’s relatively weaker fundamentals compared with gold and platinum.

Holdings in exchange-traded funds (ETFs) tied to palladium have been climbing steadily since May, with inflows accelerating in late September and early October as gold prices surpassed $4,000 per ounce.

The strategists compared the broad rally in precious metals to buoyant market sentiment, saying “like a water buoy when the tide comes in, everything on the water rises.”

They also pointed to two U.S. developments that have bolstered demand: the Critical Minerals Section 232 investigation and an antidumping petition filed by Sibanye (NYSE:SBSW) and the United Steelworkers Union. Meanwhile, palladium inventories at Nymex warehouses have reached a decade high.

Still, UBS cautioned that palladium remains a volatile investment due to its small market size and heavy reliance on the auto industry, which represents more than 80% of global demand.

On platinum, UBS raised its forecast by $200 per ounce to $1,550, noting that the metal’s bar market remains unusually tight, as seen in rising lease rates.

“We believe that the tightness reflects uncertainty around whether the United States will introduce tariffs on platinum imports,” the strategists wrote.

UBS still expects platinum to be excluded from potential tariffs, but the delay in the U.S. Critical Minerals investigation has prolonged uncertainty in the market.

The bank added that inventories at Nymex warehouses have been rising, while supply tightness in major trading hubs such as London and Zurich could continue until trade clarity emerges.

ETF holdings of platinum were subdued during the third quarter, but began to recover in October as investors increased exposure to precious metals alongside gold.