U.S. equity futures pointed to a muted start on Monday, suggesting that Wall Street may struggle to find clear direction as investors await several delayed economic reports and key corporate earnings later in the week. Markets ended last Friday nearly unchanged after staging a notable intraday rebound, and traders appear hesitant to make bold moves ahead of fresh data releases.

The temporary federal government shutdown, which delayed multiple reports, has left investors without important indicators on the state of the U.S. economy. That information is finally set to resume this morning, beginning with the Commerce Department’s August construction spending figures. Additional releases—including factory orders, the August trade balance, and the September employment report—are expected throughout the week.

While the delayed nature of these updates means the data is more backward-looking than markets would prefer, the numbers could still influence expectations for interest-rate policy ahead of the Federal Reserve’s December meeting. According to CME Group’s FedWatch Tool, traders currently assign a 57.4% probability that the Fed will keep rates unchanged next month, and a 42.6% chance of another quarter-point cut.

Nvidia (NASDAQ:NVDA) also remains a central focus for markets. The AI leader is scheduled to report third-quarter earnings after Wednesday’s closing bell, and investors will be watching closely to assess whether the company can sustain its rapid growth at a time when AI valuations have come under scrutiny. Nvidia’s guidance will be especially important given recent volatility in the tech sector.

Last week’s trading reflected that uncertainty. After steep losses on Thursday, stocks fell again in early Friday trading before technology names helped lead a strong recovery. The Nasdaq and S&P 500 both erased their earlier declines, finishing the session close to flat. The Dow, however, continued to retreat, falling 309.74 points or 0.7%.

For the week, performance was mixed: the Nasdaq slipped 0.5%, the S&P 500 edged up 0.1%, and the Dow added 0.3%.

Tech stocks initially dragged on the market again Friday due to valuation concerns, but major names such as Nvidia, Palantir (NASDAQ:PLTR), and Tesla (NASDAQ:TSLA) reversed course later in the day. Still, overall buying interest remained tepid given uncertainties about the Fed’s next steps and questions surrounding whether key economic reports will be fully released.

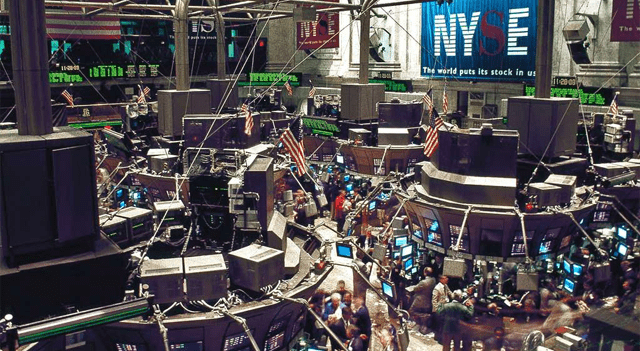

Sector-wise, weakness persisted among airlines, with the NYSE Arca Airline Index falling 2%. Retail stocks also struggled, as evidenced by a 1.1% drop in the Dow Jones U.S. Retail Index. Energy stocks were a bright spot, climbing sharply alongside crude prices—the NYSE Arca Oil Index rose 2%, and the Philadelphia Oil Service Index added 1.7%. Computer hardware and software shares also regained some ground after contributing to Thursday’s selloff.