Soluna Holdings, Inc. (NASDAQ:SLNH) rallied on Monday after the company reported third-quarter financial results that showed solid operational momentum, marked by strong sequential revenue growth and a sharp improvement in gross margins—even as overall net losses widened due to non-cash accounting adjustments.

Shares jumped 8.38% in pre-market trading following the announcement.

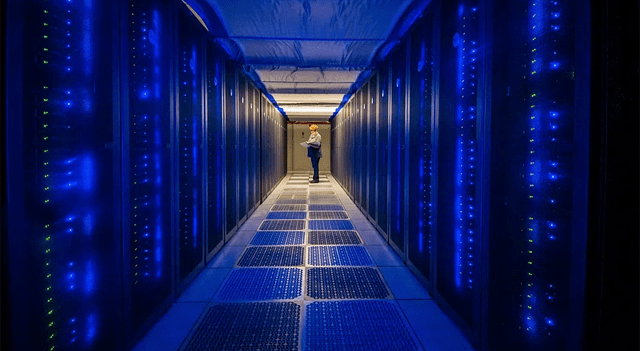

The green data-center infrastructure company posted Q3 revenue of $8.42 million, a 37% increase from the prior quarter. The company credited the performance to new customer deployments at its Dorothy 2 facility. Gross margin climbed to 28%, up from 19% in Q2, benefiting from improved cost controls, better operating efficiency, and roughly $400,000 in one-time electricity credits.

Soluna logged a quarterly net loss of -$1.14 per share, with the wider figure largely tied to non-cash items, including a $22 million fair-value adjustment related to warrants exercised following the company’s July equity raise.

“This is a new Soluna,” said John Belizaire, CEO of Soluna Holdings. “What we achieved in the third quarter reflects the exceptional execution of our small but mighty team. We’ve proven that our business model works and scales, strengthened our position as a leading Bitcoin hosting provider, and attracted new, world-class capital partners.”

The company ended the quarter with a much stronger balance sheet, boosting cash holdings to a record $60.5 million, an increase of $45 million from the previous period. The improvement was driven by approximately $64 million raised across equity offerings, warrant exercises, project-level equity and new debt financing.

Operationally, Soluna surpassed 4 EH/s of hash rate under management and now has more than 1 GW of clean-compute projects across its operating, construction, and development pipeline. The company also secured a $100 million credit facility from Generate Capital and an additional $20 million earmarked for its Project Kati 1 wind-powered computing site in Texas.

While Q3 revenue saw meaningful sequential growth, year-over-year expansion was more modest, rising from $7.53 million in the same quarter of 2024. The company highlighted strong performance from its Dorothy 1A and Sophie sites, which posted gross margins of 43.6% and 68.4%, respectively.