UBS reaffirmed its positive long-term stance on platinum, even as the bank warned that short-term volatility could create more attractive buying opportunities for investors, according to a research note published Wednesday.

The bank highlighted increasingly tight market dynamics that continue to support upward price risks for platinum — particularly if supply disruptions occur or investment flows pick up. Still, UBS cautioned that near-term uncertainty in China and soft jewelry demand may restrain upward momentum for now.

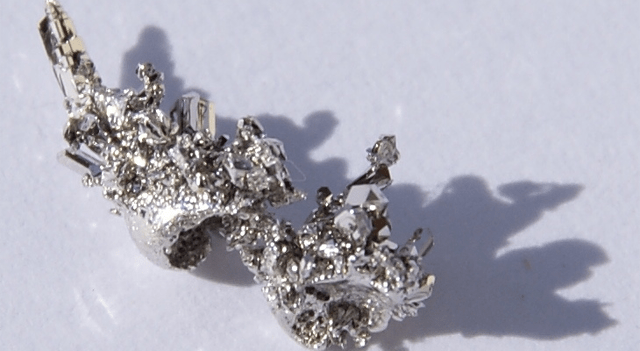

On palladium, UBS noted that the metal entered a bottoming phase in 2024, with that process extending into the first half of 2025. The bank said palladium has traded in a higher but more volatile range during the latter half of 2025 as supply-demand conditions reset.

UBS does see potential upside in palladium prices over the next year, but stressed that these moves do not alter its broader outlook, which remains defined by structurally rising surpluses. The bank believes the steepest part of palladium’s decline is now in the past.

According to the note, palladium’s recent price behavior reflects a market adjusting to new fundamentals after years of chronic deficits, alongside evolving expectations around vehicle electrification — a critical driver of demand for the metal.