Shares of Confluent Inc. (NASDAQ:CFLT) surged in premarket trading Monday after a Wall Street Journal report said International Business Machines (IBM) is close to sealing an $11 billion takeover of the data infrastructure company.

By 06:15 ET, Confluent stock was up 28.1%. According to the report, the two sides could announce a deal as early as Monday, though negotiations are not guaranteed to conclude successfully. Confluent last closed with a market capitalization near $8 billion, while IBM was valued around $290 billion.

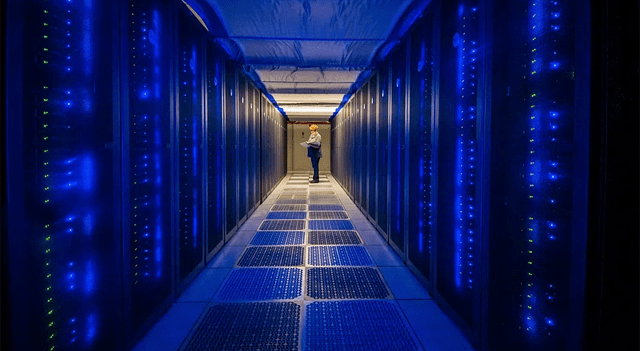

Confluent develops technology that handles real-time data streams, a capability increasingly vital for large artificial intelligence systems. Demand for its platform has grown across industries including finance, e-commerce, and retail. If completed, the acquisition would be IBM’s largest in several years and would further its strategy of doubling down on AI and data-centric software.

Jefferies analyst Brent Thill said in a note that, “We think this would be a strategically sound fit as it extends IBM’s software stack into real-time data streaming and unlocks cross-sell opportunities by pairing CFLT’s managed Kafka service with IBM’s automation, security, and global distribution.”

The potential deal follows IBM’s $6.4 billion purchase of HashiCorp last year, part of a broader push into higher-growth cloud, AI, and automation markets. IBM has also been investing heavily in quantum computing and using AI to automate certain HR tasks while shifting employees toward engineering and sales functions.

Wells Fargo analyst Ryan MacWilliams added that IBM buying Confluent “would be another data point supporting infrastructure software acquisition appetite from potential suitors, and could help support multiples for the remaining public infrastructure software vendors,” citing companies such as Informatica and Couchbase.