Duke Energy (NYSE:DUK) reported fourth-quarter earnings on Tuesday that came in just ahead of analyst estimates, while issuing 2026 guidance broadly in line with market expectations.

The utility’s shares dipped 0.18% in pre-market trading following the release.

For the fourth quarter of 2025, Duke Energy posted adjusted earnings per share of $1.50, edging past consensus forecasts by a penny. Revenue totaled $7.94 billion, comfortably above analysts’ expectations of $7.57 billion.

Looking ahead, the company guided to adjusted earnings per share of $6.55 to $6.80 for fiscal year 2026. The midpoint of $6.68 sits close to the Street consensus of $6.70. Duke Energy also reaffirmed its long-term adjusted EPS growth target of 5% to 7% through 2030, anchored off the midpoint of its 2025 guidance of $6.30.

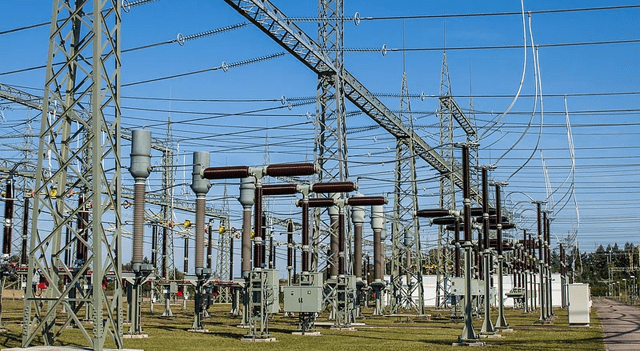

Duke Energy, a Fortune 150 company, provides electricity to around 8.7 million customers across six states and natural gas service to 1.8 million customers in five states. It continues to invest heavily in grid modernization and cleaner generation, spanning natural gas, nuclear, renewables, and energy storage, as part of its broader energy transition strategy.

The results underscore Duke Energy’s ongoing effort to fund large-scale infrastructure investments while keeping customer rates affordable and navigating the complexities of the evolving energy landscape.