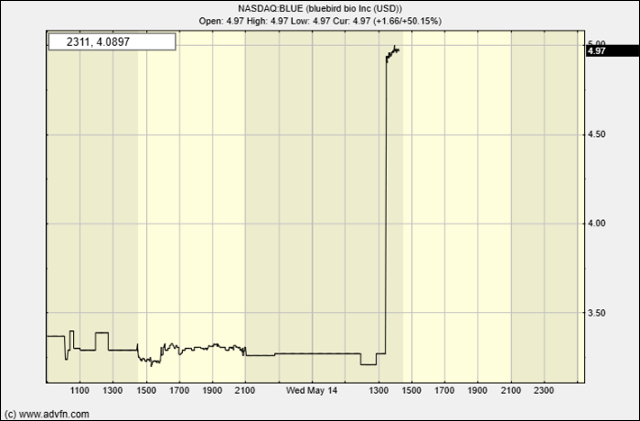

Shares of bluebird bio, Inc. (NASDAQ:BLUE) soared 50% in pre-market trading on Wednesday after the biotech firm revealed a revised acquisition proposal from private equity groups Carlyle (NASDAQ:CG) and SK Capital Partners, LP. The updated terms give shareholders two options: they can either stick with the original offer of $3.00 per share plus a contingent value right (CVR) worth $6.84, or opt for a one-time, all-cash payment of $5.00 per share without any CVR.

This alternative structure caters to different investor preferences — those looking for immediate liquidity now have a higher upfront cash option, while others still have the chance to benefit from longer-term milestone payments via the CVR.

bluebird’s board of directors has unanimously endorsed the new offer, calling it the best available path for shareholders to recover value. The board’s support also reflects growing financial pressure on the company, which recently disclosed that it faces a potential default under its loan agreements with Hercules Capital (NYSE:HTGC). A default could leave shareholders empty-handed in a worst-case scenario involving bankruptcy or asset liquidation.

To accommodate the new offer, the deadline for the tender process has been extended to just past midnight on May 29, 2025. By the close of business on May 13, roughly 2.28 million shares had already been tendered. Investors who previously accepted the original deal do not need to take further action unless they wish to switch to the new $5.00 cash alternative, in which case they must withdraw and re-tender under the updated terms.

The revised offer comes on the heels of all required regulatory approvals being secured for the buyout, which was first announced on May 5, 2025. Carlyle and SK Capital are aiming for a quick and smooth transaction close following the tender offer’s completion.

The market responded enthusiastically to the development, with investors driving up bluebird’s stock in anticipation of both the enhanced value proposition and the potential for a timely resolution to the company’s financial uncertainties.