Russian Advance, Nuclear Call

Ukrainian officials acknowledged that Russian forces made some progress in their attack on Bakhmut, while Ukrainian troops claimed to be holding on to the eastern town. The UN’s nuclear watchdog head, Rafael Grossi, visited the Zaporizhia nuclear power station, which is currently occupied by Russia, and urged for measures to protect the plant. Earlier, American and British officials had said that Russia had made little progress in capturing Bakhmut.

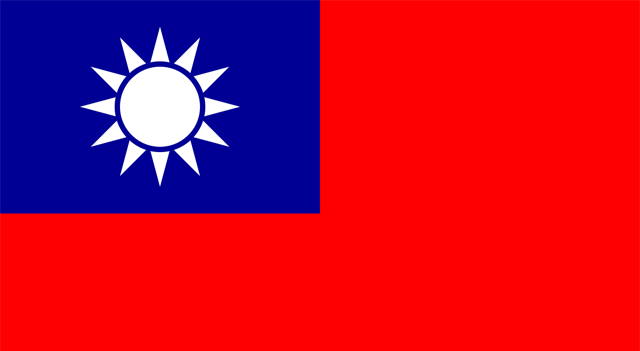

Taiwan US Visit

Taiwan’s president, Tsai Ing-wen, arrived in New York and is expected to meet the House speaker, Kevin McCarthy, on her way back, while transiting through America en route to Belize and Guatemala. China has warned that any meeting could lead to serious confrontation. However, the US has said that China should not overreact as such trips by Taiwanese leaders were a common occurrence.

Climate Legal Action

The United Nations General Assembly voted in favor of adopting a resolution that could hold countries accountable for their climate change obligations. The resolution seeks a legal opinion from the International Court of Justice about the consequences of countries failing to meet their climate change commitments. The prime minister of Vanuatu, Ishmael Kalsakau, called it a “win for climate justice.”

UK-EU Climate Plan

The United Kingdom and the European Union are cooperating to tackle climate change and respond to the US green subsidy program, signaling improving relations between the two. The UK Prime Minister, Rishi Sunak, announced that the UK and the EU could collaborate on a new carbon border tax to impose a levy on carbon-intensive goods imported into Europe. Meanwhile, the UK government will launch a consultation on whether to introduce a UK carbon border adjustment mechanism as part of a broader net-zero strategy.

Central Banks to Focus on Profit Margin

Central banks are focusing on companies using high inflation to boost their profit margins, warning that this could lead to persistent cost pressures. US companies’ profit margins reached their highest levels since World War II in 2022, while Eurozone businesses also experienced their most significant profitability growth since the 2008 financial crisis. Policymakers are shifting their focus towards these fatter profit margins, concerned about the risk of wage-price spirals in the 1970s.

Ireland ETF Dominance

Ireland has surpassed Luxembourg as an exchange-traded fund domicile in Europe, and the gap is expected to widen further. Morningstar data reveals that Ireland is now home to over two-thirds of European ETF assets, with a 67% market share and assets under management of €939bn. The second-largest domicile, Luxembourg, has a 20% share and €276bn under management. Ireland’s assets under management have grown by 159% from the end of 2018 until January, while Luxembourg’s have grown by 79%.

London as Financial Center Faces Competition

London and New York are tied for the world’s top global financial center, according to benchmarking data by the City of London’s governing body, marking the first year that the UK capital has not been the clear leader. Financial centers in other regions have grown faster, causing concerns over the competitiveness of the Square Mile. Executives in the financial services industry have warned that the UK is at risk of losing its status as a top financial center after Brexit, which forced some companies to move their operations to the EU.

UK Low Public Investment

A new report has claimed that the UK’s low level of government investment has left the country in a poorer state than other nations. The report by the Resolution Foundation think-tank revealed that public investment in the UK has averaged 2.5% of GDP per annum this century, well below the 3.7% average for industrialized countries. The UK consistently ranks among the weakest third of OECD nations.

Europe Travel Disruptions

Airlines in Europe are warning passengers of further travel disruption caused by strikes from French air traffic controllers this year. The controllers have joined a series of strikes against President Emmanuel Macron’s pension reforms, causing delays in flights that cross French airspace and those landing and taking off from French airports. The ripple effect of this disruption has affected airlines all over Europe. For instance, EasyJet (LSE:EZJ) has been “very badly hit” since many of its UK flights need to cross French airspace to reach other European destinations.

RFID Inventory System

Apparel retailers such as American Eagle Outfitters (NYSE:AEO), Victoria’s Secret & Co. (NYSE:VSCO), and Nordstrom (NYSE:JWN) are using a new generation of radio frequency identification (RFID) chips to manage their inventory systems. By tracking individual items more closely through busy environments and fulfilling more online orders through their stores, these retailers are closing the information gap in their supply chains. Although RFID technology has been used in tracking systems for containers and pallets, tracking individual pieces has been difficult due to high costs and limited technology. Retailers have traditionally taken full stock of their inventories at designated times, often when shops are closed.

Tougher Bank Rules

The White House plans to recommend tougher rules for midsize banks to the Federal Reserve and other agencies this week, according to sources. The recommendations come after the collapse of banks earlier this month sent tremors through the banking system. These recommendations are expected to include tougher capital and liquidity requirements for banks with $100 billion to $250 billion in assets. The Fed is already rethinking its rules related to these banks, and the recommendations may also include steps to strengthen annual “stress tests” that assess banks’ ability to weather severe downturns. The White House has declined to comment.

FDIC Bank Assessment

The Federal Deposit Insurance Corp. (FDIC) is considering allocating a larger portion of the almost $23 billion in costs from recent bank failures to the biggest banks in the nation. The FDIC is proposing a “special assessment” on the industry in May to strengthen a $128 billion deposit insurance fund that will take hits after the recent collapses of Silicon Valley Bank (NYSE:SVB) and Signature Bank (NASDAQ:SBNY). The regulator has said it has the flexibility to set these fees, and it is under political pressure to spare small banks.