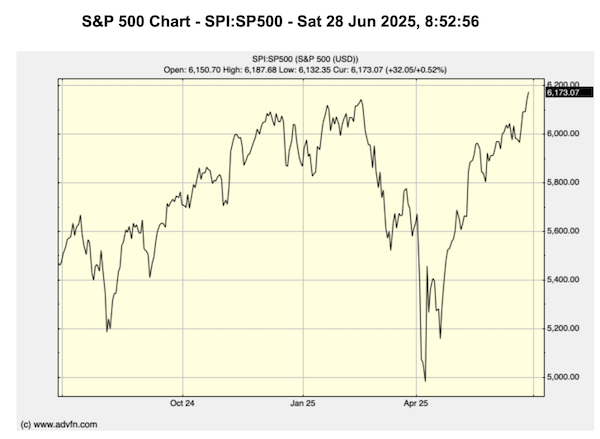

The U.S. stock market surged to new record highs on Friday, capping a remarkable rebound after teetering near bear market territory just over two months ago.

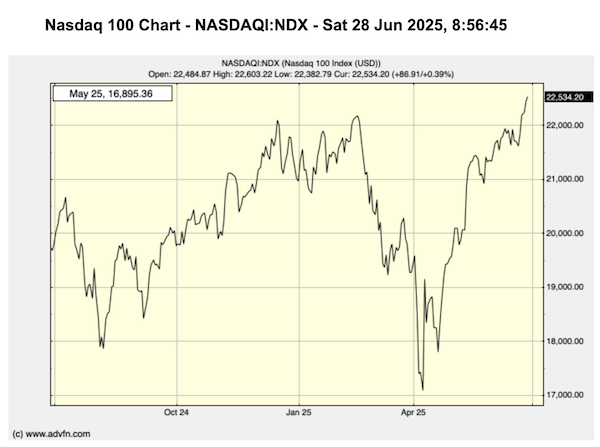

The S&P 500 rose 0.5% to close at a record 6,173.07, its first all-time high since February 19. The Nasdaq Composite also gained 0.5%, marking its first record close since December 16. Earlier in the week, the Nasdaq 100, home to the biggest tech names, had already reached new highs.

Although markets briefly dipped in the afternoon following President Donald Trump’s announcement that the U.S. was halting trade talks with Canada over a new digital services tax, stocks quickly bounced back. Trump said tariffs on Canada would be announced within a week, dampening sentiment temporarily. Still, equities regained momentum in the final hour of trading to finish the day — and the week — on a high note.

The Dow Jones Industrial Average added 432 points, or 1%. At one point, it was up 580 points, but remains about 1,200 points (2.7%) shy of its own all-time high, weighed down by declines in UnitedHealth, Apple, Merck, and Nike.

All three major indexes — the Dow, S&P 500, and Nasdaq — posted their strongest weekly performance in six weeks.

An Unlikely Recovery

Between February 19 and April 8, the S&P 500 shed nearly $9.8 trillion in market value. Few would have predicted the index would fully recover and reach new highs just 80 days later.

A large part of the volatility stemmed from escalating trade tensions. Trump’s sweeping tariffs — some reaching as high as 145% on Chinese goods — sparked inflation fears and concerns of a looming recession.

On April 9, the administration paused its “reciprocal” tariffs for 90 days in response to market reactions, calming investors. That was followed by progress in trade discussions with the UK and China, signaling that the most aggressive trade measures might be behind us.

Friday’s rally was also fueled by news that China would reopen its rare earth exports to the U.S., hours after both nations reportedly reached a breakthrough deal.

Trade Progress and AI Boom Drive Markets

Treasury Secretary Scott Bessent said Friday that he expects many trade negotiations to be wrapped up by Labor Day, aiming for agreements with at least 10 to 12 of the U.S.’s 18 key trading partners.

Beyond trade, investor optimism has been bolstered by a surge in artificial intelligence, led by strong demand for Nvidia chips and a push from Republican lawmakers to deregulate the industry. Hopes for interest rate cuts by the Federal Reserve, supported by resilient economic data and low inflation, have added to the momentum.

Even as Congress passed a sweeping tax and domestic policy package last month, demand for U.S. Treasury bonds has remained strong — a sign that global investors still have faith in America’s economic stability.

“Investors are catching on,” said Art Hogan, chief market strategist at B. Riley Wealth Management. “They know to take some of these headline shocks with a grain of salt.”

Risks Still Linger

Despite the celebratory mood on Wall Street, challenges remain.

If Congress fails to pass the domestic spending bill, including raising the debt ceiling, the U.S. could once again flirt with default. Should no new trade agreements materialize, the paused tariffs may snap back into effect as early as July 9.

Geopolitical tensions remain, particularly in the Middle East, where a fragile truce between Israel and Iran could unravel. Meanwhile, existing tariffs could gradually push prices higher, potentially slowing economic growth.

There are also market-specific concerns: valuations have become stretched. The S&P 500’s price-to-earnings ratio has climbed above 23 — historically high and suggesting stocks may be overvalued relative to earnings expectations.

For now, the markets are celebrating. But whether the rally can last is still an open question.