U.S. Inflation Rises as Strong Earnings Lift Markets

United States

Stocks Hit New Highs on Earnings Strength

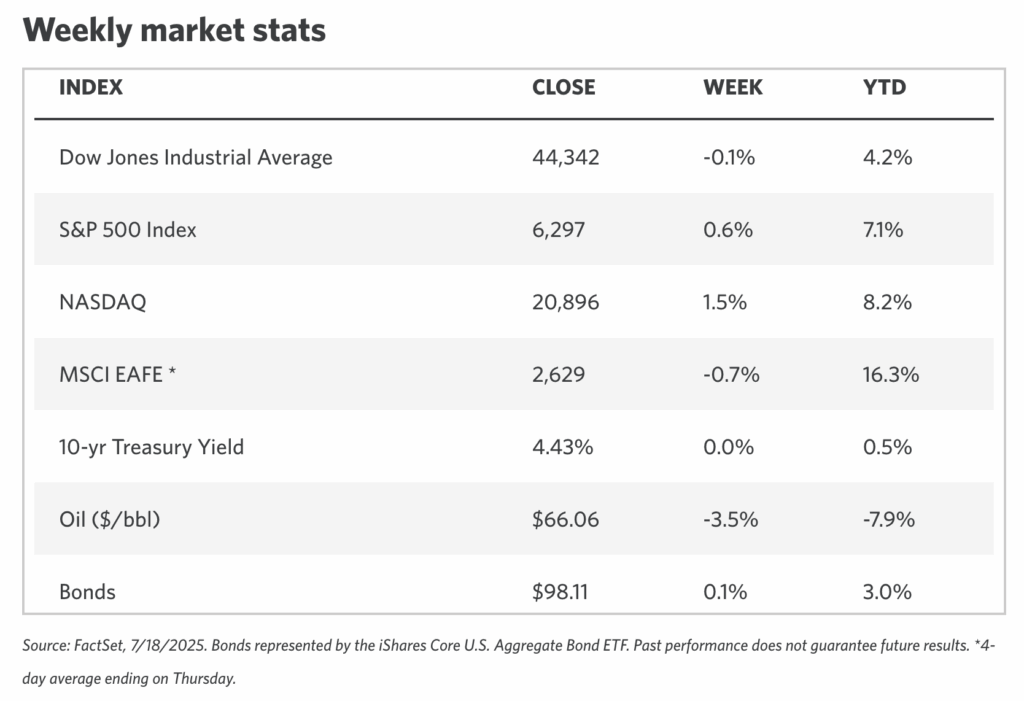

U.S. equities rallied, with the S&P 500 and Nasdaq Composite reaching fresh record highs, supported by strong corporate earnings and generally positive economic data. The small-cap Russell 2000 also posted gains, while the Dow Jones Industrial Average and S&P Midcap 400 ended the week slightly lower.

Earnings season kicked off in earnest, with major banks including JPMorgan Chase and Citigroup reporting better-than-expected Q2 results. Later in the week, companies like PepsiCo, United Airlines, and Netflix also beat analysts’ forecasts.

Chipmaker NVIDIA surged after announcing it received approval from the Trump administration to sell its H2O AI chips to China. The company, which recently crossed the USD 4 trillion market cap threshold, rose sharply on the news.

Inflation Picks Up; Retail Sales Recover

The June Consumer Price Index (CPI) rose 0.3% month over month—its largest increase in five months—driven in part by higher tariffs. On a year-over-year basis, headline CPI accelerated to 2.7% from 2.4% in May. Core CPI, which excludes food and energy, ticked up to 2.9% from 2.8%.

Retail sales rebounded strongly, rising 0.6% in June following a 0.9% drop in May. Investor sentiment briefly wavered midweek amid reports that President Trump was considering removing Fed Chair Jerome Powell. However, markets recovered after Trump denied the reports.

Bond Markets and Fed Speculation

Intermediate and long-term Treasury yields were largely unchanged, while short-term yields declined slightly amid uncertainty over Fed leadership. Investment-grade corporate bonds outperformed Treasuries, with new issuance broadly oversubscribed and in line with expectations.

Europe

Markets Flat; UK Inflation Surprises on the Upside

The STOXX Europe 600 Index ended the week little changed, as investors awaited developments in U.S.-EU trade talks. Country-level performance was mixed: Italy’s FTSE MIB rose 0.58%, France’s CAC 40 and Germany’s DAX were flat, and the UK’s FTSE 100 gained 0.57%, helped by a weaker pound.

UK Economic Data Disappoints

UK inflation rose unexpectedly to 3.6% in June from 3.4% in May, marking the fastest pace since January 2024. Services inflation remained stubbornly high at 4.7%, raising concerns for the Bank of England.

The labor market showed signs of softening. Unemployment rose to 4.7%—a four-year high—and payroll employment declined by 41,000 in June. Wage growth (excluding bonuses) came in at 5.0%, slightly above expectations but down from May’s 5.3%.

Eurozone Industrial Activity Rebounds

Euro area industrial production jumped 1.7% in May, beating expectations and rebounding from April’s 2.2% decline. Energy, capital goods, and consumer nondurables led the increase. On a year-over-year basis, output rose 3.7%.

The eurozone trade surplus widened more than expected in May to EUR 16.2 billion, as exports rose and imports declined.

German Sentiment Hits Multi-Year High

Germany’s ZEW economic sentiment index rose for a third straight month to 52.7—its highest level since early 2022—driven by expectations of new stimulus and potential resolution of EU-U.S. trade disputes.

Asia Pacific

Japan: Modest Gains Amid Political Uncertainty

Japanese stocks posted modest gains ahead of the July 20 Upper House election. The Nikkei 225 rose 0.63%, while the TOPIX added 0.40%. Investors are watching whether Prime Minister Shigeru Ishiba’s coalition can retain majority control and what direction the new cabinet will take on fiscal policy.

The 10-year JGB yield rose to 1.53% on expectations of increased government spending. The yen weakened, trading in the mid-148 range against the U.S. dollar.

Inflation Eases, Trade Data Disappoints

Core CPI rose 3.3% year over year in June, slightly below expectations and down from May’s 3.7%, largely due to reduced energy costs. Meanwhile, exports fell 0.5% year over year in June, missing expectations, with steep declines in shipments to both the U.S. and China. The U.S. announced it will impose a 25% reciprocal tariff on Japanese imports beginning August 1, though trade negotiations are ongoing.

China: Solid GDP, But Headwinds Persist

Mainland markets posted gains, with the CSI 300 up 1.09% and the Shanghai Composite up 0.69%. Hong Kong’s Hang Seng Index jumped 2.84%.

Q2 GDP growth came in at 5.2% year over year, slightly above expectations, potentially reducing near-term stimulus pressure. However, deflationary forces, weak retail sales, and renewed U.S. trade tensions could weigh on growth in the second half.

China’s housing slump continues to drag on the economy. New home prices in 70 cities fell 0.27% in June, while existing home values dropped 0.61%. Residential sales declined 12.6% year over year, the sharpest drop so far in 2025.

Other Key Markets

Indonesia: Rate Cut and U.S. Trade Agreement

Indonesia’s central bank cut its benchmark rate to 5.25% from 5.50%, citing lower inflation forecasts and the need to support economic growth. The U.S. and Indonesia also finalized a trade agreement that included a lower-than-expected 19% tariff on Indonesian exports and large-scale purchases of U.S. goods, including Boeing aircraft and energy products.

Peru: Central Bank Holds Steady Amid Mixed Signals

Peru’s central bank left its benchmark rate unchanged at 4.50%, noting that economic activity is near potential. Inflation remained stable at 1.7%, and forward inflation expectations stayed within the target range. However, the bank flagged concerns about rising inflation expectations abroad, particularly in the U.S., which could slow the path to domestic price stability.

Follow the world markets on InvestorsHub.com

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.