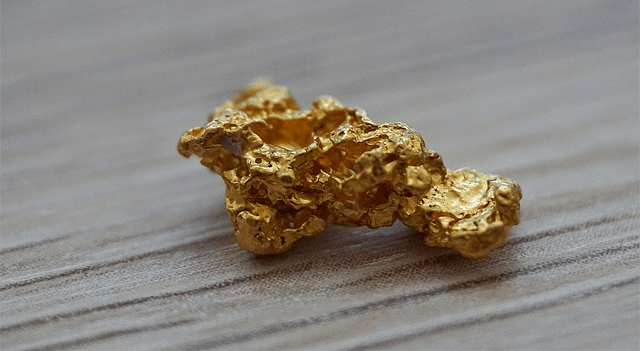

Gold prices dipped slightly on Tuesday following a strong rally on Monday that pushed them to over a month’s high. Despite the pullback, concerns about U.S. tariffs and interest rate moves kept demand for gold and other safe-haven metals elevated.

At 04:25 ET (08:25 GMT), spot gold was down 0.2% at $3,389.27 per ounce, after climbing 1.4% on Monday. Gold futures fell by the same margin, settling near $3,401.12 an ounce.

U.S. Tariff Deadline Fuels Market Nervousness

With the August 1 deadline looming, markets remained unsettled over impending U.S. tariffs. Investor optimism for a U.S.-EU trade deal waned as reports emerged that the EU is preparing retaliatory tariffs in response to the U.S. raising tariff levels beyond earlier expectations.

The Trump administration has also indicated that the deadline will likely not be postponed. Over the past two weeks, President Donald Trump issued multiple letters announcing tariffs between 20% and 50% on major trading partners, escalating market anxiety and provoking threats of retaliation.

This climate of uncertainty has bolstered demand for precious metals like gold, silver, and platinum, which have seen notable price increases. On Tuesday, some profit-taking occurred, with spot silver retreating 0.4% to $39.165 an ounce and spot platinum dropping 0.5% to $1,488.10 an ounce.

Industrial metals showed modest gains, with copper futures on the London Metal Exchange up 0.1% to $9,879.25 per ton and COMEX copper futures rising 0.2% to $5.6480 per pound. The U.S. is set to impose a 50% tariff on copper from August 1.

Inventory data from the Shanghai Futures Exchange indicated rising stocks across key base metals last week. Copper inventories increased by 3,094 tonnes to 84,556 tonnes as of Friday, aluminium climbed by 5,625 tonnes to 108,822 tonnes, and zinc rose 9.3% week-over-week to 54,630 tonnes, its highest level since mid-April.

Bernstein Sees Higher Long-Term Gold Prices

Analysts at Bernstein cautioned that many traditional models for predicting gold prices are now outdated or ineffective. They identified six forecasting methods centered on government and monetary policies that remain reliable, leading them to project gold prices reaching $3,700 per ounce by 2026—significantly above the current Wall Street consensus of $3,073.

Dollar Retreats Slightly on Fed Watch

The dollar eased a bit on Tuesday after two weeks of gains, coinciding with gold’s recent rally. Market participants expect the Federal Reserve to hold interest rates steady at its upcoming meeting.

However, worries over the Fed’s autonomy persist amid speculation that President Trump may try to replace Chair Jerome Powell, who has shown little appetite for cutting rates—much to the administration’s frustration.

Powell is due to speak later in the day, although it’s unclear whether he will discuss monetary policy given the Fed’s typical media blackout ahead of meetings.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.