On Wednesday, American Electric Power (NASDAQ:AEP) reported adjusted earnings for the second quarter of 2025 that far surpassed analyst expectations, fueled by robust customer growth and targeted investments.

The utility’s stock gained 1.57% in pre-market trading after the earnings release.

AEP delivered adjusted earnings of $1.43 per share, outperforming the analyst consensus of $1.22 by 17.2%. Revenue reached $5.09 billion, exceeding the expected $4.9 billion and marking an 11.1% increase from $4.58 billion in the same quarter last year. The company raised its full-year earnings guidance to the upper half of the $5.75 to $5.95 per share range and reaffirmed its long-term growth outlook of 6% to 8%.

“Our record second-quarter results reflect the strength of our customer-focused strategy and the dedication of our teams across the company,” said Bill Fehrman, AEP president and CEO.

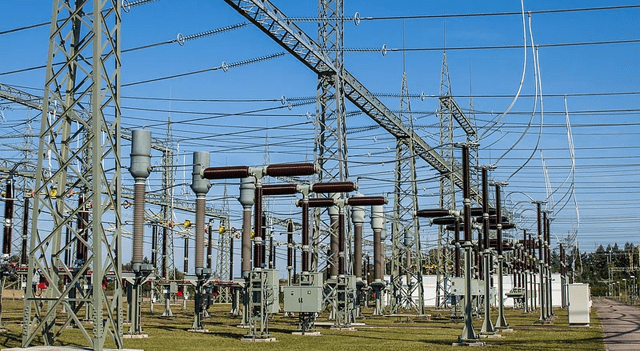

The company highlighted strong customer load growth, with agreements secured for 24 gigawatts of new load by 2030, up from 21 gigawatts previously announced. This growth is expected to push AEP’s peak load beyond 60 gigawatts, making it one of the fastest-growing utilities in the sector.

Looking ahead, AEP plans to unveil a new five-year capital plan this fall totaling approximately $70 billion, a significant increase from its current $54 billion plan, aiming to support rising customer demand. The company has also bolstered its financial position through strategic deals, including a $2.82 billion investment by KKR and PSP Investments for a 19.9% stake in its Ohio and Indiana Michigan transmission units.

“AEP is strategically positioned for sustained growth as we transform the electric grid and invest in new resources to meet the generational load growth opportunity in front of us,” Fehrman added.

American Electric Power stock price

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.