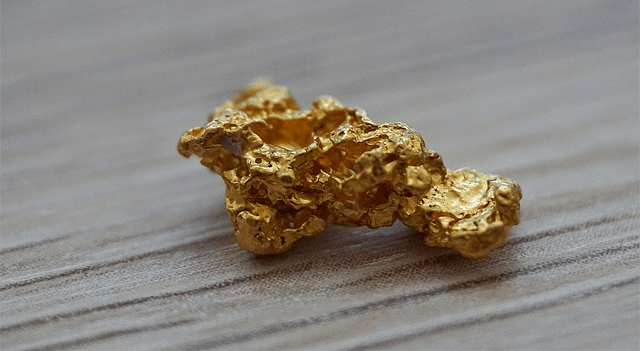

Gold prices held steady in early Tuesday trading, pausing after a strong multi-day run fueled by increasing bets on U.S. interest rate cuts and ongoing worries over global trade tensions.

As of 01:00 ET (05:00 GMT), spot gold was little changed at $3,372.25 per ounce, while December futures hovered around $3,425.02, showing minimal movement.

Weak Jobs Data Boosts Gold as Fed Cut Bets Rise

Gold’s recent momentum came after soft U.S. economic data sparked speculation that the Federal Reserve is gearing up for rate cuts. The metal surged over 2% on Friday following the July nonfarm payrolls report, which revealed a modest 73,000 job gain, well below expectations. In addition, figures for May and June were revised lower, while the jobless rate increased to 4.2%, adding to concerns about the health of the economy.

Market participants now see a 92% likelihood that the Fed will ease policy in September, according to the CME FedWatch Tool. This shift in sentiment has helped drive demand for gold, a traditional safe-haven asset that tends to perform well when interest rates fall.

A modest rebound in the U.S. Dollar Index after recent declines slightly capped gains, but the overall macro environment remains favorable for gold bulls.

Trade Policy Uncertainty Adds to Gold’s Appeal

Gold also found support from trade-related developments. U.S. Trade Representative Jamieson Greer confirmed that wide-ranging tariffs imposed by President Trump on nearly 70 nations are expected to remain in effect, renewing concerns about global supply chains and inflationary pressure.

In a separate development, markets were rattled by Trump’s threat to escalate tariffs on India, citing the country’s oil dealings with Russia. These geopolitical flashpoints have reinforced gold’s role as a store of value during uncertain times.

Mixed Action in Broader Metals Market

Elsewhere in the metals complex, platinum futures dipped 0.5% to $1,335.65/oz, while silver futures inched up 0.2% to $37.415/oz.

In the industrial metals space, London copper futures gained 0.3% to $9,720.65 per ton, while U.S. copper held flat at $4.454 per pound.

Last week, U.S. copper prices plunged 20% after the government excluded refined copper from its proposed 50% import tariff, creating volatility across the market.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.