VNET Group, Inc. (NASDAQ:VNET) reported second-quarter results on Thursday that fell short of analyst forecasts, despite showing solid revenue growth, causing its shares to drop 3.5%.

The company posted a loss of RMB0.06 per share for the quarter, missing the projected profit of RMB0.11 per share. Total revenue reached RMB2.43 billion ($339.8 million), surpassing the consensus estimate of RMB2.3 billion and marking a 22.1% increase compared to the same period last year.

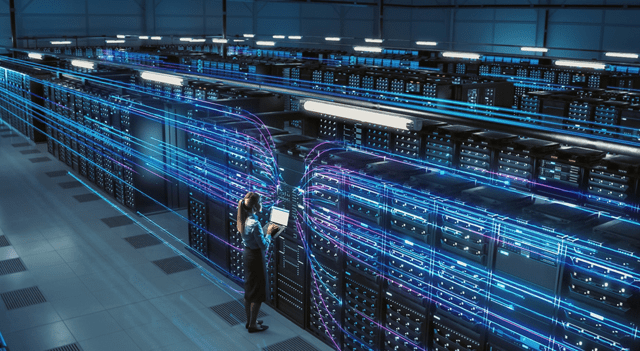

VNET’s wholesale IDC segment was the main engine behind growth, with revenues soaring 112.5% year-over-year to RMB854.1 million ($119.2 million). Meanwhile, retail IDC revenue remained largely steady at RMB958.7 million ($133.8 million), compared to RMB964.8 million in Q2 2024.

“We delivered strong second quarter results thanks to continued effective strategic execution,” said Josh Sheng Chen, Founder, Executive Chairperson and interim Chief Executive Officer of VNET. “Our wholesale IDC business continued to grow rapidly, driven by our wholesale data centers’ fast move-in pace.”

Adjusted EBITDA climbed 27.7% year-over-year to RMB732.5 million ($102.2 million), with an adjusted EBITDA margin of 30.1%, up 1.3 percentage points from the same quarter last year.

The company reiterated its full-year 2025 revenue guidance, expecting total revenue between RMB9.15 billion and RMB9.35 billion, representing 11-13% growth from 2024. This outlook aligns with analyst expectations of RMB9.35 billion.

VNET’s wholesale capacity in service nearly doubled to 674MW as of June 30, 2025, up from 332MW a year earlier.

The company also recently introduced its “Hyperscale 2.0” strategy, which outlines plans to expand its data center capacity to 10GW by 2036.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.