UBS has revised its lithium price forecasts upward following an in-depth review showing that widespread and prolonged supply interruptions in China could affect as much as 15% of global lithium output.

The bank now anticipates spodumene prices rising 9-32% and lithium chemical prices climbing 4-17% between 2025 and 2028, reflecting the impact of mining suspensions in China. Key disruptions include the idling of CATL’s Jianxiawo mine and potential compliance-related shutdowns at other sites.

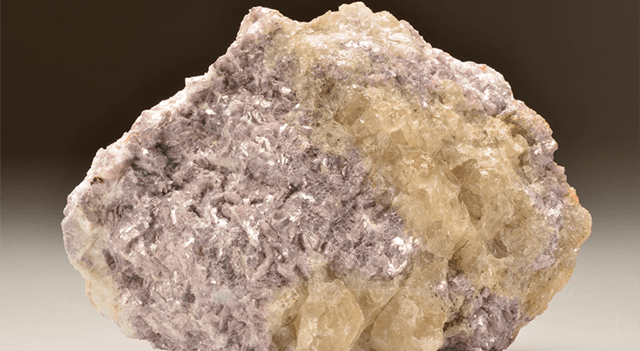

Analysts at UBS highlighted several critical events: Zangge Mining’s halt on July 14, CATL’s suspension on August 10, seven lepidolite mines in Yichun at risk after September 30, and production limits at Citic Guoan’s Qinghai brine facility. The bank expects strict enforcement of mining rights inspections by Chinese authorities, with CATL potentially idle for up to 12 months and other operations facing varying levels of disruption.

Global electric vehicle (EV) sales continue to expand robustly, with June showing a 26% year-on-year increase, led by China’s 31% growth. Chinese EV manufacturers now account for roughly 64% of global EV sales, despite a contraction in the North American market.

Battery energy storage system (BESS) demand is also rising sharply. The global project pipeline has surged 117% year-on-year, representing around 1.7TWh of planned capacity for 2025–2030.

UBS projects the lithium market will face a near-term deficit in 2026, with some supply returning in 2027. While the bank’s near-term spodumene price outlook remains above consensus, longer-term expectations for both spodumene and lithium chemicals are below market forecasts.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.