Oil prices softened in Asian trading Thursday as investors weighed a larger-than-expected drop in U.S. crude inventories against the effect of new U.S. tariffs on Indian oil imports.

By 21:34 ET (01:34 GMT), October Brent futures were down 0.5% at $67.71 per barrel, while WTI futures fell 0.6% to $63.80 per barrel.

U.S. Crude Draw Exceeds Forecasts

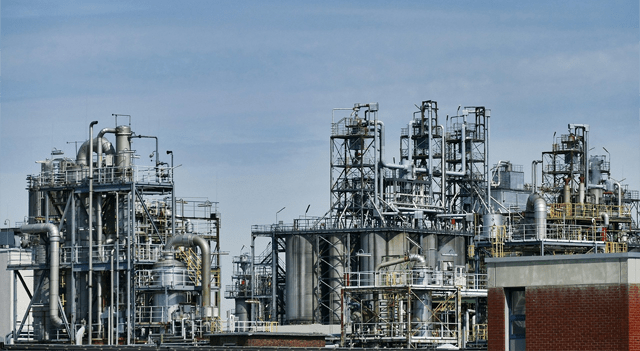

Data from the Energy Information Administration showed U.S. crude stocks declined by 2.4 million barrels in the week ending August 22, surpassing analyst expectations of a 1.9 million-barrel drop. Gasoline inventories fell 1.2 million barrels, and distillate stocks dropped 1.8 million barrels. Implied gasoline demand rose to 9.24 million barrels per day from 8.84 million bpd the previous week, reflecting strong seasonal consumption.

The figures point to robust summer driving, but analysts caution that demand may weaken once the seasonal peak ends, potentially reducing refinery margins and limiting further gains for crude prices.

India Faces 50% U.S. Tariff

The U.S. imposed an additional 25% tariff on Indian oil imports Wednesday, raising the total duty to 50% from August 27, in response to India’s ongoing purchases of Russian crude.

Indian refiners briefly paused imports of Russian oil after the tariffs were announced but have since resumed purchases, suggesting limited impact on crude flows. Market watchers expect close attention on Russian oil shipments to India to gauge the ongoing effect.

Geopolitical tensions also continue to influence the market. U.S. President Donald Trump has sought to mediate in the Ukraine conflict, warning last week that fresh sanctions on Moscow could follow if no progress toward a peace deal is reached within two weeks.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.