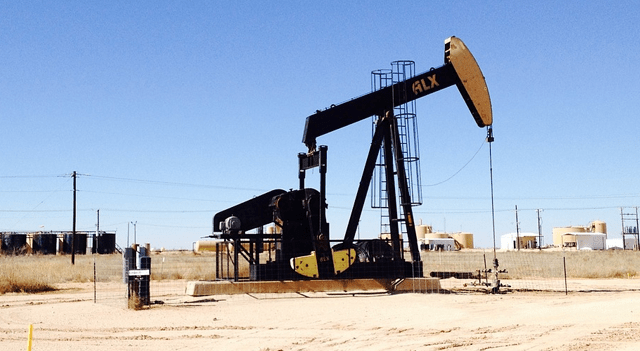

Oil markets edged higher in Asian trading on Monday, buoyed by expectations of tighter supply after OPEC+ decided to raise production at a slower rate in October. Continued geopolitical tensions, particularly the Russia-Ukraine conflict, added support, while U.S. attempts at a ceasefire have yet to make substantial progress.

Brent crude for November delivery rose 0.6% to $65.90 per barrel, and West Texas Intermediate (WTI) futures increased 0.6% to $61.83 per barrel by 20:56 ET (00:56 GMT).

OPEC+ Cuts Back on Production Hikes

The Organization of Petroleum Exporting Countries and its allies announced a cumulative production increase of 137,000 barrels per day for October, far below earlier monthly increases of 555,000 bpd and 411,000 bpd. Saudi Arabia, leading the alliance, had previously expanded output to regain market share amid softening oil prices. OPEC+ emphasized caution, citing potential declines in global demand as economic indicators point to slower growth in the U.S. and subdued activity in China.

Market Pressures and Recent Movements

Last week, Brent and WTI futures fell 3–4% amid concerns over global demand. The declines accelerated after weaker-than-expected U.S. nonfarm payroll data suggested slowing economic momentum. While expectations of lower U.S. interest rates weakened the dollar, concerns over reduced fuel consumption persisted. U.S. inventory reports showed unexpected builds, and domestic fuel demand cooled as the summer travel season ended, raising the possibility of a supply surplus during the northern hemisphere winter.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.