Chinese robotaxi operator Pony AI Inc (NASDAQ:PONY) is expected to hit a significant profit benchmark by the end of 2025 or early 2026, according to the Wall Street Journal, citing statements from CFO Leo Haojun Wang.

Wang told the publication that Pony is “well on track” to achieve single-unit economic break-even and could even report a positive margin by the turn of the year. He credited the company’s progress to expanding its fleet, reducing insurance expenses, and growing its user base.

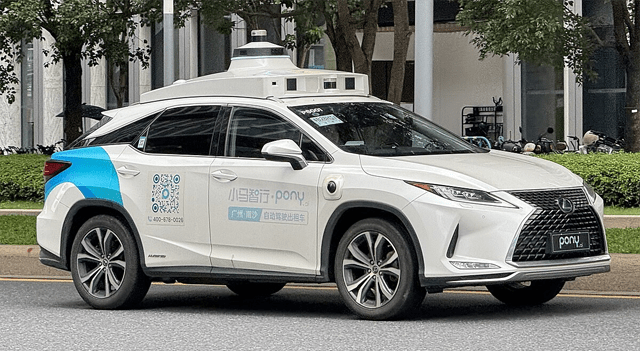

In China, several robotaxi companies, including WeRide and Apollo Go backed by Baidu, are striving to reach single-unit economic break-even — a measure that indicates profitability with each additional vehicle added to their fleets.

This metric is seen as crucial for the companies’ overall profitability, especially given the billions invested in developing and testing autonomous taxi technology.

Wang added that Pony AI has already produced 400 robotaxis and plans to deploy 1,000 vehicles worldwide.

China’s robotaxi market is currently the largest and most competitive globally, with Pony AI and its rivals far outpacing U.S. counterparts. In the United States, Waymo is the only major robotaxi operator, while Tesla maintains limited autonomous vehicle operations in Texas.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.