Gold prices remained largely unchanged in Asian trading on Wednesday, staying close to recent record highs after remarks from U.S. Federal Reserve Chair Jerome Powell stirred market concerns over growth, inflation, and interest rates.

Safe-haven demand for gold and other precious metals rose, while a persistently soft U.S. dollar kept metals supported. Traders also exercised caution ahead of key economic releases this week, coupled with disappointing U.S. purchasing managers index (PMI) results.

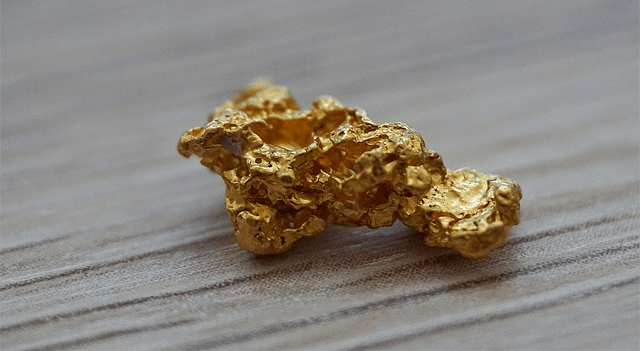

Spot gold inched up 0.3% to $3,776.20 an ounce, while gold futures eased 0.2% to $3,808.50 per ounce as of 01:39 ET (05:39 GMT).

Powell Highlights Economic Uncertainty

Spot gold hit a record $3,791.10 an ounce on Tuesday, maintaining its elevated levels after a strong rally last week.

Fed Chair Powell warned Tuesday evening that the U.S. economy faces heightened uncertainty, emphasizing that there is no “risk-free path” for cutting interest rates while keeping inflation in check and sustaining job growth.

He also noted that the labor market had weakened significantly in recent months, while inflation remains persistent, complicating efforts to ease monetary policy.

These comments came just a week after the Fed reduced interest rates by 25 basis points, signaling that further easing could be on the horizon. Gold surged following the rate cut, as lower yields tend to make non-yielding assets such as metals more attractive.

Market expectations, as tracked by CME FedWatch, suggest at least two additional 25-basis-point cuts this year. Further signs of U.S. economic softness could prompt the Fed to extend monetary easing, with the dollar remaining near three-year lows.

U.S. PMI Weakness Adds to Caution

September PMI readings indicated slower-than-expected expansion in both manufacturing and services, as companies faced higher trade tariffs, persistent inflation, and subdued consumer spending.

Other Metals Move Higher

Other precious metals gained on Wednesday, with spot platinum climbing 0.6% to $1,485.41 per ounce and spot silver rising 0.5% to $44.2495 per ounce.

Industrial metals also saw modest gains, with London Metal Exchange copper futures up 0.1% at $9,999.95 per ton and COMEX copper futures edging up to $4.6430 per pound.

Focus Shifts to Key U.S. Data

Investors are closely watching upcoming U.S. economic releases, including the final second-quarter GDP reading on Thursday, which is expected to confirm stronger-than-anticipated growth.

The PCE price index, the Fed’s preferred measure of inflation, is due Friday, and analysts expect inflation to remain elevated in August. Several Fed officials are also scheduled to speak in the coming days, providing additional potential market-moving commentary.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.