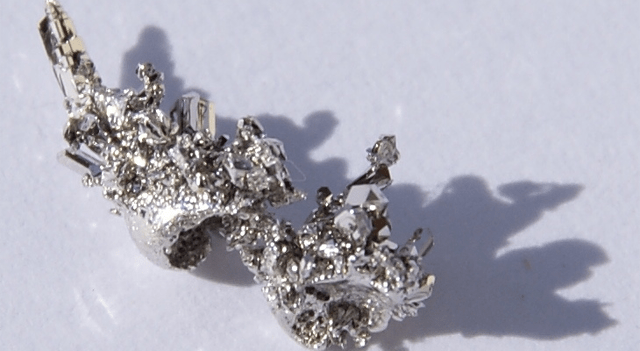

In its latest metals outlook released Tuesday, UBS reiterated a cautious stance on palladium, highlighting the metal’s strong reliance on conventional vehicles.

The investment bank pointed out that over 80% of palladium consumption is linked to catalytic converters in internal combustion engine (ICE) cars, creating a concentrated demand risk for the precious metal.

Although the adoption of electric vehicles outside China has been slower than initially expected, UBS emphasized that the global shift away from ICE-powered vehicles remains firmly underway.

According to the bank’s analysts, this ongoing transition is likely to push the palladium market toward a structural surplus. UBS said this trend is expected to manifest “at some point over the coming years,” without specifying exactly when the market could see this shift.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.