Super Micro Computer (NASDAQ:SMCI) pared earlier losses to trade down just 0.5% on Tuesday, outperforming a broader tech sector downturn, after unveiling a new business line focused on full-scale data center solutions.

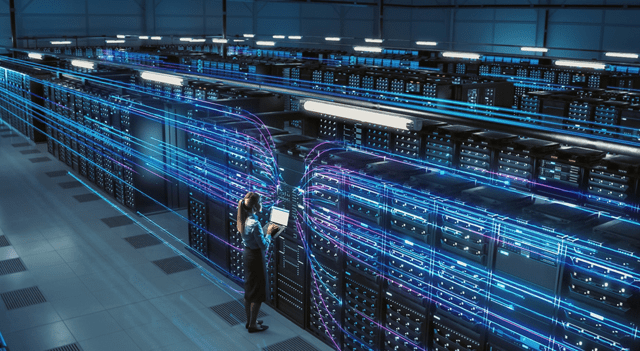

The San Jose-based IT infrastructure company introduced Data Center Building Block Solutions (DCBBS), positioning itself as an end-to-end provider for complete data center infrastructure. This new offering bundles computing systems, storage, networking, cooling infrastructure, and management software — all pre-tested and integrated at Supermicro facilities before shipping.

The company said the DCBBS model is designed to streamline data center deployments by sourcing all IT components from a single vendor, speeding up time-to-online and enhancing reliability. It also highlighted that its liquid-cooling technology can cut energy consumption by up to 40% compared to traditional air-cooled systems.

“With our expertise in delivering solutions to some of the largest data center operators in the world, we realized that supplying a complete IT infrastructure solution will benefit many organizations seeking to simplify their data center buildout,” said Charles Liang, president and CEO of Supermicro.

The product line will incorporate advanced AI and compute systems using technology from NVIDIA Corporation, Advanced Micro Devices, and Intel Corporation, as well as petascale storage solutions. Customers will also have access to a suite of cooling options, including liquid cooling cold plates, coolant distribution units, and rear door heat exchangers.

The launch underscores Supermicro’s push to expand beyond its traditional server hardware segment into more integrated data center services, tapping into growing demand for AI-driven infrastructure solutions.

Super Micro Computer stock price

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.