Hillenbrand, Inc. (NYSE:HI) surged 19% on Wednesday after announcing it had agreed to be acquired by private equity firm Lone Star Funds in an all-cash transaction valued at $32.00 per share. The deal represents a total enterprise value of roughly $3.8 billion.

The offer price reflects a 37% premium to Hillenbrand’s unaffected closing price on August 12 — the day before deal speculation emerged — and a 53% premium over the company’s 90-day volume-weighted average price.

The acquisition, unanimously approved by Hillenbrand’s Board of Directors, comes after the company evaluated several strategic options. Once completed, expected by the end of the first quarter of 2026, Hillenbrand will become a private company and its shares will be delisted from the NYSE.

“We are pleased to reach this agreement with Lone Star, which delivers immediate and certain cash value to our shareholders at a substantial premium to recent trading,” said Helen Cornell, Chairperson of the Board of Directors.

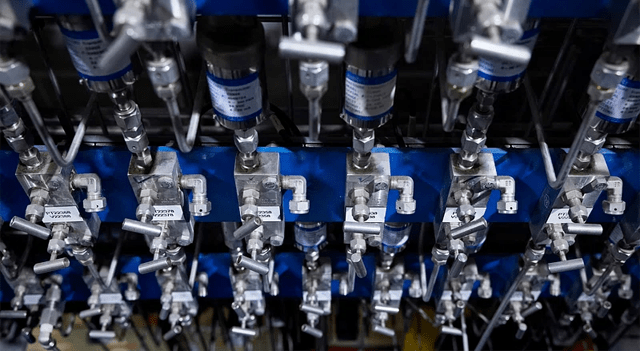

Hillenbrand, known for its engineered processing equipment through its Advanced Process Solutions and Molding Technology Solutions divisions, has reshaped its business over the past three years through targeted acquisitions and divestitures to strengthen its industrial food equipment portfolio.

Donald Quintin, CEO of Lone Star, stated: “We are excited to partner with Hillenbrand, a high-quality operator in the industrial equipment sector.”

The deal remains subject to Hillenbrand shareholder approval and regulatory clearance.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.