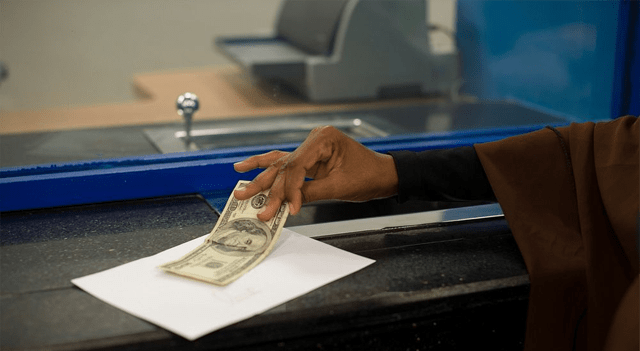

The U.S. dollar weakened further on Friday, heading for its steepest weekly slide in nearly three months, as renewed anxiety over the banking sector reinforced expectations of additional interest rate cuts from the Federal Reserve later this year.

At 04:10 ET (08:10 GMT), the U.S. Dollar Index — a gauge of the dollar’s strength against six major peers — dipped 0.1% to 97.975. The index is down 0.7% this week, on track for its largest weekly decline since late July.

Regional bank stress weighs on the greenback

The dollar came under added pressure as investors digested troubling signals from the U.S. regional banking sector. Zions Bancorporation and Western Alliance Bancorporation both disclosed loan issues linked to fraud, sparking fresh questions about financial stability amid slowing U.S. growth.

“The contagion to other risk assets shows not only that markets are still sensitive to regional bank concerns (a legacy of SVB’s 2023 collapse), but potentially to the broader credit market, which has been operating on exceptionally tight spreads over the past few months,” said analysts at ING Group.

Combined with global trade tensions and soft economic data, the news has strengthened the argument for the Fed to ease policy further.

“In such a volatile environment, it’s hard to pick a bottom for USD. DXY [the dollar index] might need to slip back all the way to 97.50 before finding strong support, unless some encouraging domestic U.S. news comes to the rescue today,” ING added.

Euro gets a political boost

EUR/USD climbed 0.2% to 1.1713 after French Prime Minister Sébastien Lecornu survived two no-confidence votes on Thursday by agreeing to delay a key pension reform.

“That is … enough for the euro to price out a good portion of the French risk premium, and barring a new government collapse before year-end, this should allow EUR/USD to refocus on canonical market drivers (rates and equities),” ING said.

The single currency was also buoyed by diplomatic developments: U.S. President Donald Trump and Russian President Vladimir Putin are expected to meet in the coming weeks to discuss an end to the war in Ukraine.

Elsewhere, GBP/USD slipped 0.1% to 1.3424, giving up part of Thursday’s gains after fresh data showed the U.K. economy returned to modest growth in August.

Yen rallies ahead of BOJ meeting

The Japanese yen strengthened sharply, sending USD/JPY down 0.6% to 149.60. The move came after Kazuo Ueda, Governor of the Bank of Japan, said the central bank would continue raising interest rates if confidence in its economic outlook improves.

While Ueda gave no clear timetable or size for future hikes, his comments helped support the yen ahead of the BOJ’s upcoming policy meeting at the end of October.

Mixed moves among other majors

USD/CNY edged up 0.1% to 7.1269, with the yuan little changed this week as firmer midpoint fixes were countered by weak inflation data and rising U.S.-China trade tensions.

AUD/USD fell 0.5% to 0.6449 as the Australian dollar faced pressure from soft employment data, which increased market bets on further monetary easing from the Reserve Bank of Australia.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.