HSBC upgraded Freeport-McMoRan (NYSE:FCX) to Buy from Hold and raised its price target to $50 from $43, citing a supportive environment for copper and gold prices that should bolster earnings, even as the miner faces operational setbacks at its flagship Grasberg mine in Indonesia.

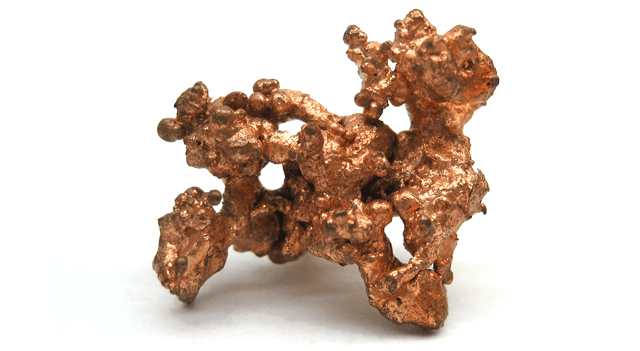

Copper has outperformed other base and bulk metals this year amid supply disruptions, while precious metals have surged to multi-decade highs.

HSBC said Freeport is well positioned to capitalize on these favorable price trends and noted that the stock has recently lagged behind its peers. Grasberg, which represents roughly 3% of global copper supply and plays a key role in Freeport’s earnings, has been under force majeure since a deadly mud rush in September.

While HSBC trimmed its production forecasts for the coming years, projecting only a gradual ramp-up, it emphasized that higher metals price assumptions more than compensate for those revisions.

Other analysts also believe that concerns around Grasberg are overblown. Citi called Freeport “a rare opportunity to buy into the world’s largest copper miner at a discount,” noting that the operational issues at Grasberg are not structural and production should recover. Bernstein similarly argued that the market reaction to the incident has been too severe.

HSBC’s valuation uses a blend of discounted cash flow and EV/EBITDA multiples, leading to a $50 per share target — about 17% higher than the current price of $41.

The bank cautioned, however, that downside risks remain, including weaker-than-expected metals prices, delays at Grasberg, and regulatory challenges in Indonesia and the U.S.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.