Cleveland-Cliffs Inc. (NYSE:CLF) posted a third-quarter adjusted loss of $0.45 per share on Monday, matching analyst forecasts, while revenue reached $4.7 billion, just shy of the expected $4.9 billion.

The stock edged up 0.30% in premarket trading as investors responded to encouraging signs of a rebound in automotive steel demand.

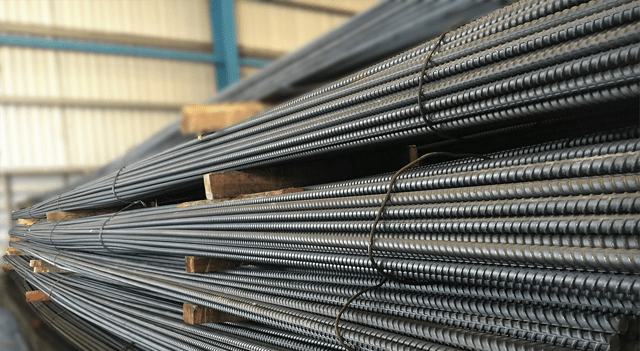

Third-quarter steel shipments climbed to 4.0 million net tons, compared to 3.8 million tons a year earlier, reflecting stronger orders from automakers. Revenue slipped slightly from $4.9 billion in the second quarter of 2025, while adjusted EBITDA improved to $143 million from $94 million in the prior period.

“Our third quarter results marked a clear sign of demand recovery for automotive-grade steel made in the USA, and that is a direct consequence of the new trade environment,” said Lourenco Goncalves, Cleveland-Cliffs’ Chairman, President and CEO. “We have won new and growing supply arrangements with all major automotive OEMs, locking in multi-year agreements.”

The company adjusted its full-year 2025 outlook, cutting projected capital expenditures to about $525 million from $600 million and lowering SG&A expenses to $550 million from $575 million. It reiterated its plan to achieve steel unit cost savings of roughly $50 per net ton compared with 2024.

Cleveland-Cliffs also announced it had signed a Memorandum of Understanding with a major global steelmaker, which it expects to be “highly accretive” to shareholders. It further outlined plans to explore rare earth mineral opportunities at its Michigan and Minnesota mining sites.

As of September 30, 2025, the company reported total liquidity of $3.1 billion.

This content is for informational purposes only and does not constitute financial, investment, or other professional advice. It should not be considered a recommendation to buy or sell any securities or financial instruments. All investments involve risk, including the potential loss of principal. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Some portions of this content may have been generated or assisted by artificial intelligence (AI) tools and been reviewed for accuracy and quality by our editorial team.