Shares of major gold and silver producers fell sharply on Tuesday as precious metal prices backed away from their recent record-breaking rally, with silver miners leading the downturn.

Barrick Gold Corporation (NYSE:B), Agnico Eagle Mines Limited (NYSE:AEM), Kinross Gold Corporation (NYSE:KGC), Newmont Corporation (NYSE:NEM), Eldorado Gold Corporation (NYSE:EGO) and AngloGold Ashanti Limited (NYSE:AU) each fell around 4% during the session. Gold Fields Limited (NYSE:GFI) slid 6%.

Losses were even steeper in the silver sector: Pan American Silver Corp. (NYSE:PAAS) and Hecla Mining Company (NYSE:HL) fell 6%, First Majestic Silver Corp. (NYSE:AG) and Coeur Mining, Inc. (NYSE:CDE) slipped 7%, while Endeavour Silver Corp. (NYSE:EXK) dropped 8%.

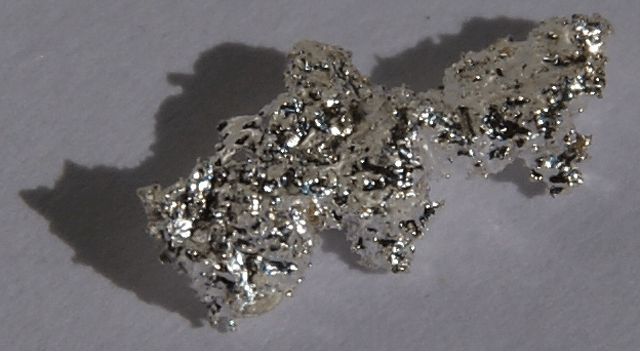

The selloff followed a sharp pullback in metal prices: gold retreated from Monday’s all-time high of $4,381.50 per ounce to $4,220, while silver slid from $54.50 to $49.20 per ounce.

Investor sentiment turned more cautious as hopes for a resolution to the U.S. government shutdown and easing trade tensions gained traction, dampening demand for traditional safe-haven assets. The retreat followed a historic rally that had sent both metals to unprecedented levels.

For miners, whose earnings are highly sensitive to underlying commodity prices, the reversal in gold and silver translated directly into weaker valuations and accelerated selling pressure across the sector.