RTX (NYSE:RTX) raised its full-year financial outlook on Tuesday after posting third-quarter earnings that exceeded market expectations, fueled by continued strength in its defense and commercial aerospace businesses. Shares of the U.S. defense contractor surged more than 6% in premarket trading following the announcement.

The company reported earnings per share of $1.70 for Q3, comfortably beating the consensus estimate of $1.41. Revenue rose 11% year-over-year to $22.5 billion, ahead of analyst forecasts of $21.27 billion.

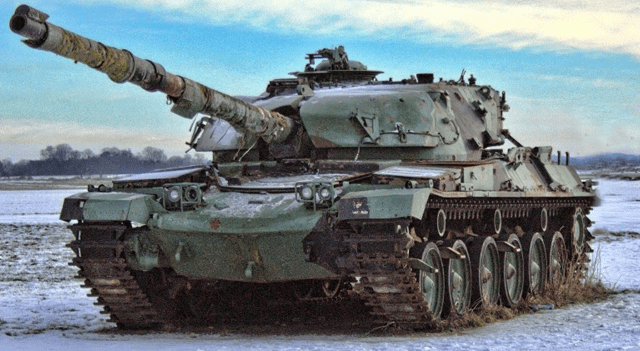

Collins Aerospace, the company’s avionics and aerospace unit, delivered $7.62 billion in quarterly revenue, marking an 8% increase from a year earlier. Sales at the Pratt & Whitney engine business climbed 16% to $8.42 billion, supported by robust demand for Airbus A320neo engines. Meanwhile, Raytheon, RTX’s defense arm, recorded a 10% sales increase, benefiting from strong orders for its Patriot air defense systems, which remain in active use in Ukraine.

“Strong execution in the third quarter enabled us to deliver double-digit organic sales growth across all three segments and our sixth consecutive quarter of year-over-year adjusted segment margin expansion,” said RTX Chairman and CEO Chris Calio. “We also received $37 billion of new awards in the quarter, reflecting robust global demand for our products and supporting long-term growth for RTX.”

“We remain focused on executing on our $251 billion backlog and increasing our output to support the ramp across critical programs, while investing in next-generation products and services that meet the needs of our customers,” he added.

For the full year 2025, RTX raised its earnings forecast to a range of $6.10–$6.20 per share, compared to its previous outlook of $5.80–$5.95 and above the $5.95 consensus estimate. The company now anticipates revenue between $86.5 billion and $87.5 billion, up from its earlier guidance of $84.75 billion to $85.5 billion.

Organic sales growth is expected to reach 8% to 9% for the year, an improvement from the prior range of 6% to 7%, as the company benefits from record order intake and a growing defense backlog.