Shares of Super Micro Computer Inc (NASDAQ:SMCI) tumbled nearly 10% in premarket trading Wednesday after the server maker posted fiscal first-quarter results that missed expectations on both earnings and revenue, even as it raised its outlook for the current quarter and full year.

The disappointing figures sparked concerns about near-term execution and demand stability, though optimism around longer-term artificial intelligence (AI) infrastructure growth remains intact.

For the quarter ended September 30, Supermicro reported non-GAAP earnings per share of $0.35, below analyst forecasts of $0.46. Revenue came in at $5.02 billion, well short of the $5.8 billion consensus estimate, down from $5.9 billion a year earlier and roughly flat versus the previous quarter.

Gross margin contracted to 9.3% from 9.5% in the prior quarter and was well below the 13.1% level recorded a year ago. Operating income declined sharply to $182.3 million from $509.2 million last year, while research and development spending surged to $173.3 million from $132.2 million, underscoring Supermicro’s continued investment in AI and datacenter technologies.

CEO Charles Liang maintained a positive tone despite the soft quarter, pointing to strong momentum in large-scale deployments. “With a rapidly expanding order book, including more than $13B in Blackwell Ultra orders, we expect at least $36 billion in revenue for fiscal year 2026,” Liang said in a statement.

While Q1 results disappointed investors, the company lifted its Q2 revenue forecast to a range of $10.0–$11.0 billion—well above the $7.9 billion average Wall Street estimate—signaling faster conversion of its order backlog. It guided for non-GAAP earnings per share between $0.46 and $0.54, below consensus but still indicating meaningful sequential growth.

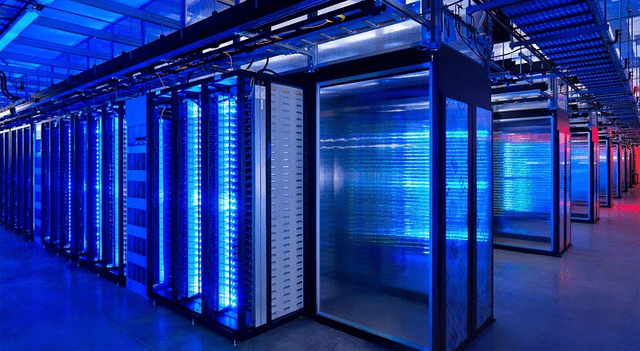

Supermicro continues to evolve into a fully integrated AI and datacenter solutions provider, with strategic partnerships with chipmakers NVIDIA and AMD helping support its growth pipeline. The company said AI-driven demand remains a key driver of both its backlog and upcoming product launches, particularly as enterprises and cloud providers invest heavily in next-generation infrastructure.

However, investors remain cautious as execution challenges persist. Cash flow from operations swung to an outflow of $918 million during the quarter, while the company ended with $4.2 billion in cash and $4.8 billion in debt, reflecting strong liquidity but rising working capital demands.

As Supermicro positions itself for massive opportunities in AI infrastructure, Wall Street is likely to focus on how effectively the company can manage costs and margins while meeting surging demand. For now, its raised outlook offers reassurance, though near-term volatility suggests the path ahead remains bumpy.