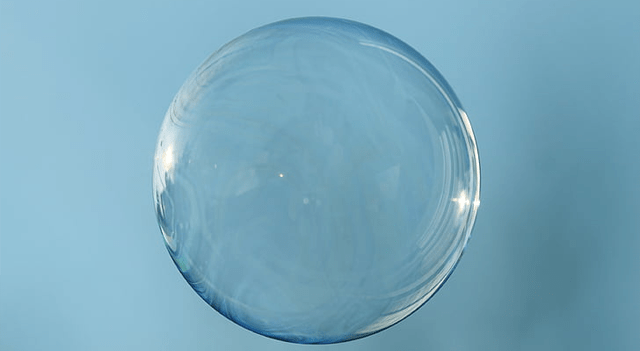

Financial markets are increasingly uneasy about the parallels between today’s technology boom and the speculative surge of 1999. While debate continues over whether artificial intelligence (AI) represents a true bubble, several indicators suggest that investors should exercise greater caution.

That’s the conclusion of Goldman Sachs strategists, who warned in a note published Sunday that the market’s growing enthusiasm for AI “risks reproducing the bursting of the Internet bubble of the early 2000s.”

Although current valuations have not yet reached the extremes of the late 1990s, analysts said the AI investment frenzy closely mirrors the dot-com mania of that era.

“We are seeing a growing risk that the imbalances that built up in the 1990s will become more visible as the AI investment boom continues. We have recently been seeing echoes of the inflection point of the 1990s boom,” the bank noted, adding that AI-related investment today looks similar to tech spending in 1997, several years before the bubble burst.

To help investors navigate the current environment, Goldman Sachs highlighted five warning signals that preceded the collapse of technology stocks more than two decades ago.

1. Peak Investment Spending

According to Goldman, technology investment reached extreme levels in the late 1990s, just as the dot-com bubble began to deflate. Capital spending on hardware and software hit “unusually high levels,” peaking in 2000, when telecom and tech investments accounted for nearly 15% of U.S. GDP.

Today, investors are again expressing concern about record AI spending by major tech firms. Goldman estimates that Amazon, Meta, Microsoft, Alphabet, and Apple could collectively invest about $349 billion in capital expenditures by 2025.

2. Corporate Profits Peaked Before the Crash

Profitability peaked in late 1997, several years before the market collapsed.

“Profitability peaked well before the end of the boom,” Goldman analysts said. “While reported profit margins were stronger, the decline in profitability reflected in macroeconomic data during the final years of the boom coincided with an acceleration in stock prices.”

For now, corporate earnings appear solid. FactSet data show that the S&P 500’s net profit margin for Q3 stood at 13.1%, above the five-year average of 12.1%.

3. Rising Corporate Debt

Goldman also pointed to the rapid increase in corporate borrowing leading up to the early 2000s crash. The ratio of corporate debt to profits peaked in 2001, right as the bubble was bursting.

“The combination of increased investment and lower profitability has pushed the financial balance of the corporate sector — the difference between savings and investment — into deficit,” strategists wrote.

While some AI investments have been funded through new debt, such as Meta’s $30 billion bond issuance in late October, Goldman noted that most firms are now using internal cash flows to finance spending. Corporate leverage ratios also remain far below those seen during the dot-com era.

4. Fed Rate Cuts Supported Risk-Taking

In the late 1990s, the Federal Reserve’s rate-cutting cycle helped fuel speculative behavior.

“Lower interest rates and capital inflows have fueled the stock market,” Goldman said.

The pattern is partially repeating today: the Fed cut interest rates by 25 basis points in October and is expected to reduce them again by another 25 basis points in December, further stimulating market optimism.

5. Widening Credit Spreads

Finally, Goldman noted that credit spreads began widening before the 2000 crash, signaling rising investor caution.

Credit spreads — the difference between corporate bond yields and Treasury yields — tend to widen when perceived risk increases. While spreads remain historically tight, Goldman observed that they have started to expand in recent weeks, potentially hinting at mounting financial stress.

Echoes of the Past

Goldman’s warning suggests that while AI may represent a transformative technology, the market’s euphoria could be repeating the same behavioral patterns that led to one of the most infamous collapses in financial history.

In other words, as the bank implies, the AI boom of today may be closer to 1997 than 1999 — but history shows how quickly excitement can turn into excess.